How does the 52-week savings challenge work? You save an amount equal to the week number throughout the year. Week 1, save $1. Week 2, save $2. Week 3, save $3. By week 52, you’re saving $52. At the end of the year, you’ll have $1,378. The gradual increase makes starting easy, though the final weeks require larger deposits when holiday expenses often hit hardest.

The challenge has become one of the most popular savings methods because it requires no complex budgeting, works with almost any income level, and provides a clear goal with measurable weekly progress. Whether you’re building an emergency fund, saving for a vacation, or just trying to develop better financial habits, the 52-week challenge offers a structured path that many people find easier to follow than vague “save more money” resolutions.

The Basic Math and Schedule

The standard 52-week challenge follows a simple progression that anyone can understand. Here’s how the numbers break down across the year.

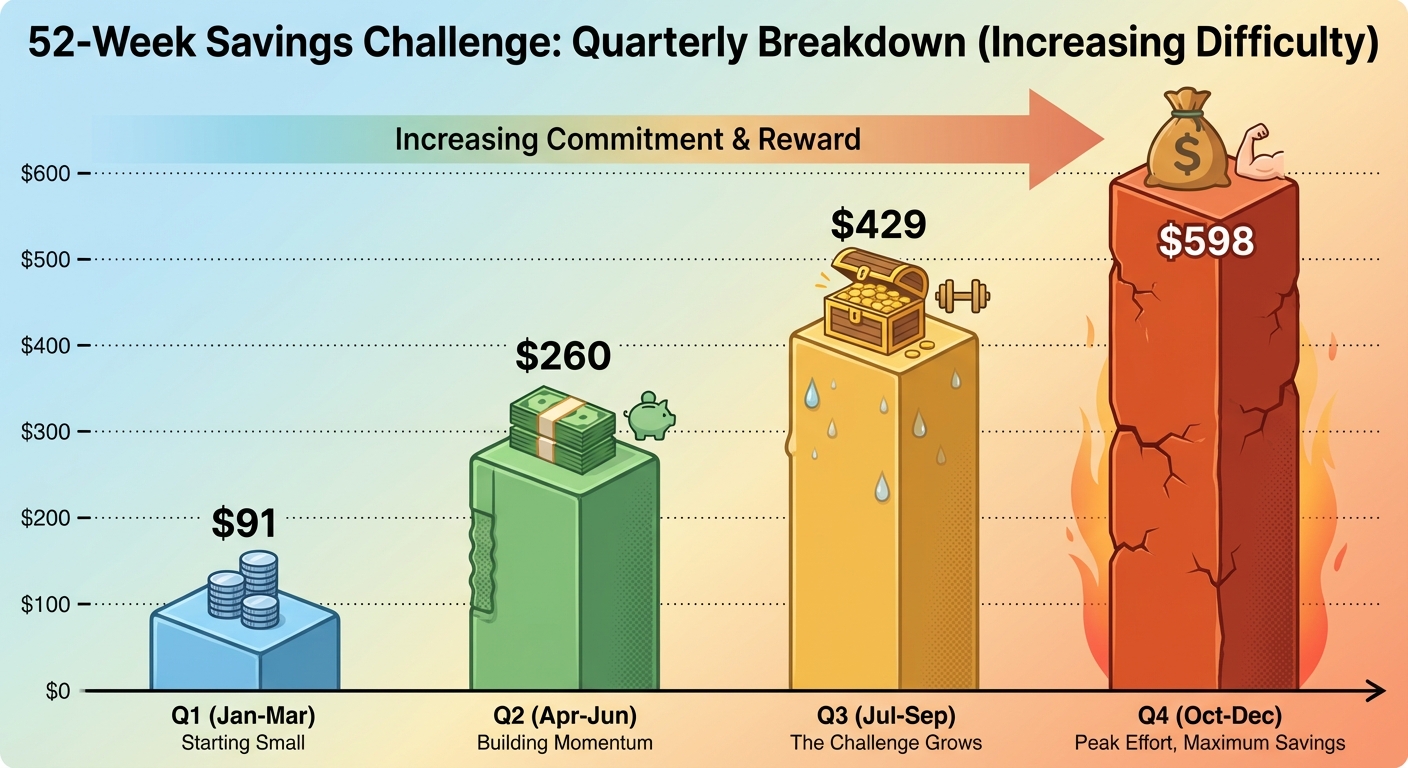

Weeks 1-13 (Q1): You’ll save $1 through $13, totaling $91 for the quarter. These early weeks are deliberately easy. The small amounts help establish the habit without straining your budget. Most people find the first three months completely manageable.

Weeks 14-26 (Q2): Savings range from $14 to $26 per week, adding $260 to your total. The amounts are noticeable now but still reasonable for most budgets. By the end of June, you’ll have accumulated $351.

Weeks 27-39 (Q3): Weekly savings climb from $27 to $39, contributing $429 to your account. This is where some people start feeling the pinch. The weekly amounts now equal a modest grocery run or a tank of gas.

Weeks 40-52 (Q4): The final stretch requires $40 through $52 per week, totaling $598. This quarter alone accounts for 43% of your annual savings. Unfortunately, it coincides with holiday shopping season, when most people have the least flexibility in their budgets.

The total of $1,378 comes from the formula: 1+2+3+…+52 = (52 × 53) ÷ 2 = $1,378.

Popular Variations That Work Better

The original challenge has a design flaw: it’s hardest when money is tightest. Several variations address this problem while keeping the same $1,378 goal.

Reverse 52-week challenge: Start with $52 in week 1 and decrease by $1 each week. You’ll save $52, $51, $50, and so on down to $1 in the final week. This front-loads the heavy lifting when New Year’s motivation is highest and makes December’s holiday season much easier with just $10 total due in the last four weeks.

Bi-weekly variation: If you’re paid every two weeks, combine two weeks into each paycheck. Pay $3 from your first check (weeks 1+2), $7 from your second check (weeks 3+4), and so on. This aligns your savings with your income rather than arbitrary calendar weeks.

Flexible weekly version: Print out all 52 amounts and cross off whichever one you can afford each week. Had a good week? Cross off the $45. Tight on money? Cross off the $3. As long as you cross off all 52 amounts by year’s end, you reach the same total. This variation removes the stress of a fixed schedule while maintaining accountability.

Double challenge: For those who can afford more aggressive savings, double every amount. Week 1 becomes $2, week 2 becomes $4, and so on. You’ll end the year with $2,756 instead of $1,378.

Making the Challenge Stick

Starting is easy. The first few weeks feel almost trivial. The real challenge is maintaining momentum through months of increasing commitments. Here’s what actually helps people finish.

Automate the transfers. Set up automatic weekly transfers from checking to savings. Most banks let you schedule recurring transfers for specific amounts on specific days. Automation removes the decision-making that leads to skipped weeks. You can even set up 52 individual scheduled transfers at the start of the year if your bank allows it.

Use a separate account. Open a dedicated savings account for the challenge. Mixing challenge money with regular savings makes progress invisible and tempts you to dip into it. A separate account with a nickname like “52-Week Challenge” provides visual proof of your progress every time you check the balance.

Track visually. Print a chart and mark each week’s contribution. Physical tracking creates satisfaction that checking an app balance doesn’t provide. Some people use a thermometer-style tracker, coloring in sections as they progress toward $1,378.

Plan for the hard weeks. Look ahead at November and December now. Those final weeks require $40 to $52 each. If your budget typically tightens around the holidays, consider the reverse challenge or build a buffer earlier in the year by occasionally contributing more than the minimum.

Is the 52-Week Challenge Worth It?

The challenge works best for people who struggle with unstructured saving. If telling yourself to “save what you can” results in saving nothing, the clear weekly targets provide accountability that vague intentions lack. The gamification aspect, crossing off weeks and watching the total grow, motivates people who respond to visible progress.

The $1,378 outcome is meaningful but not transformative. It’s a solid start to an emergency fund (financial advisors typically recommend three to six months of expenses). It could fund a modest vacation. It provides a financial cushion that many Americans lack: surveys consistently show nearly 60% of people can’t cover a $1,000 emergency expense.

For people already comfortable with saving, the challenge might feel unnecessarily restrictive. If you can easily save $265 per month (the same $1,378 divided evenly), the weekly variation adds complexity without benefit. The challenge’s value lies in building the habit for people who don’t yet have one.

The biggest risk is quitting mid-year after a few missed weeks. Life happens: unexpected expenses, income disruptions, or simply forgetting. If you miss a week, don’t abandon the challenge. Catch up when you can or switch to the flexible version where you cross off amounts in any order. Partial completion still leaves you better off than not trying.

Getting Started This Week

If you’re reading this in January, you’re at the ideal starting point. Here’s how to begin today.

Open a separate savings account if you don’t have one. Most banks offer free savings accounts with no minimum balance. Online banks often provide higher interest rates, letting your challenge money grow slightly as it accumulates.

Set up your first automatic transfer. Even if it’s just the $1 or $2 for this week, starting immediately builds momentum. You can adjust the automation for future weeks later.

Choose your tracking method. Download a 52-week challenge printable, use a spreadsheet, or find a dedicated app. The method matters less than having some visual way to mark progress.

Decide on your variation now, not after you’re struggling in October. If December is typically tight for you financially, start with the reverse challenge. If your income is irregular, commit to the flexible version from day one.

The 52-week challenge won’t make you wealthy, but it can prove to yourself that consistent saving is possible. That psychological shift, from “I can’t save money” to “I successfully saved $1,378 this year,” often matters more than the dollars themselves.