Tax season 2026 officially begins on Monday, January 26, 2026. That’s the first day the IRS will accept and process 2025 federal income tax returns. The deadline to file is Wednesday, April 15, 2026, giving you just under 12 weeks to get everything submitted.

If you’re eager to file early, the IRS Free File program opened on January 9, 2026, for taxpayers with adjusted gross income of $84,000 or less. These free services let you prepare and submit your return before the official start date, though the IRS won’t actually process it until January 26.

This filing season comes with some notable changes. The One, Big, Beautiful Bill introduced several new deductions, including provisions for tips, overtime, and car loan interest. There’s also a new form, Schedule 1-A, that you may need if you’re claiming any of these new tax breaks.

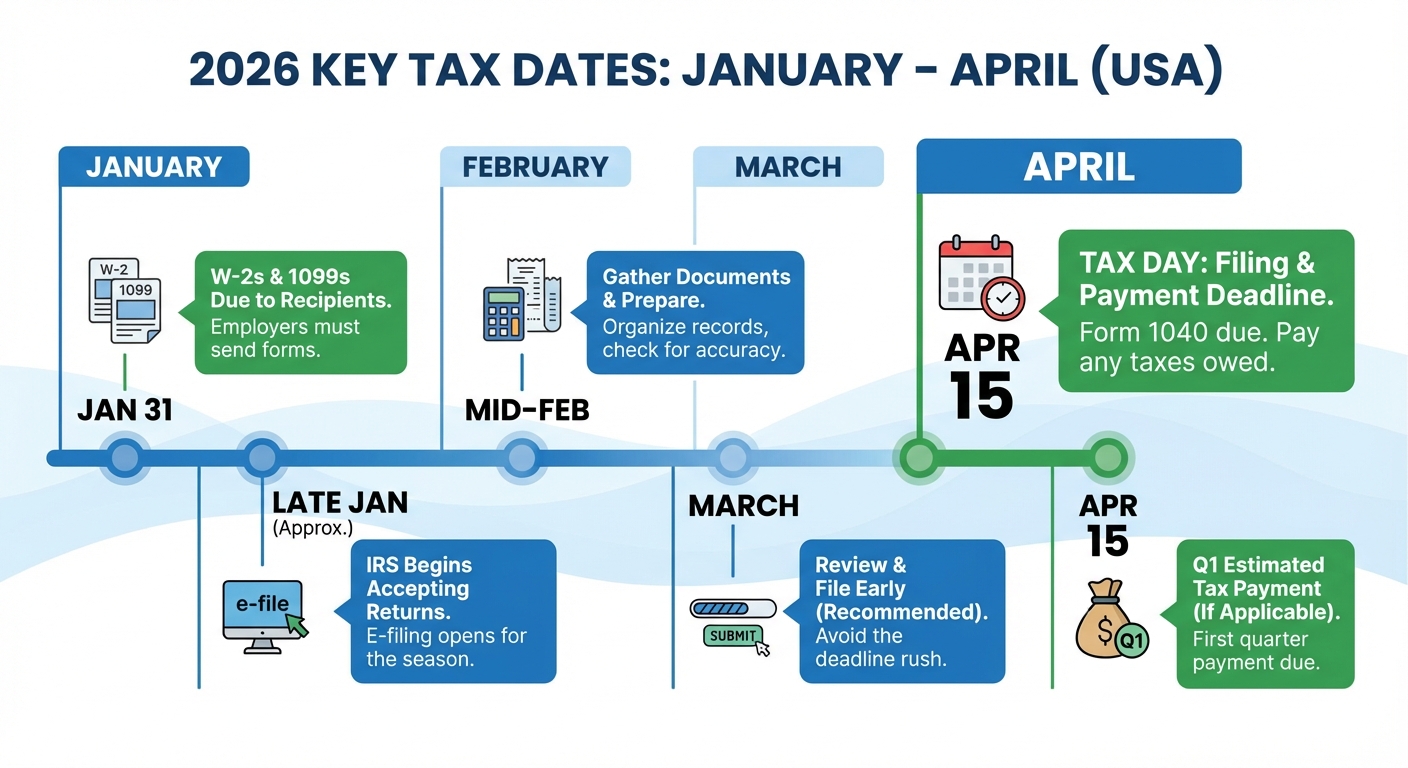

Key Tax Dates for 2026

Here are the dates you need to mark on your calendar:

| Date | What Happens |

|---|---|

| January 9, 2026 | IRS Free File opens for early submissions |

| January 26, 2026 | IRS begins processing all tax returns |

| January 31, 2026 | Deadline for employers to send W-2s |

| January 31, 2026 | Deadline for 1099 forms to be mailed |

| April 15, 2026 | Tax filing and payment deadline |

| April 15, 2026 | Last day to request an extension |

| October 15, 2026 | Extended filing deadline |

If you can’t file by April 15, you can request an automatic six-month extension using Form 4868. But here’s the catch many people miss: an extension to file is not an extension to pay. If you owe taxes, you’re still required to estimate and pay what you owe by April 15 to avoid penalties and interest.

What You Need Before You File

Before jumping into tax software or heading to a preparer, gather these essential documents:

Income Documents:

- W-2 forms from all employers

- 1099 forms (for freelance income, interest, dividends, retirement distributions)

- Records of any other income (rental, cryptocurrency transactions, side gigs)

Deduction and Credit Documents:

- 1098 forms for mortgage interest and student loan interest

- Records of charitable donations

- Medical expense receipts (if itemizing)

- Childcare expense records (for the child tax credit)

- Education expenses (for education credits)

New for 2026:

- Records of tip income (if claiming the no-tax-on-tips deduction)

- Documentation of overtime hours worked (if claiming the overtime deduction)

- Car loan statements (if claiming the auto loan interest deduction)

You’ll also need your Social Security numbers for yourself, your spouse if filing jointly, and any dependents. If you filed last year, having your previous return handy can speed things up, especially if you’re using the same software.

Free Filing Options

The IRS offers several ways to file for free, though eligibility varies:

IRS Free File: If your adjusted gross income is $84,000 or less, you can use free tax preparation software through the IRS Free File program. Several tax software providers participate, offering their products at no cost through the IRS website.

IRS Direct File: The IRS Direct File program, launched in 2024, is available to taxpayers in participating states with straightforward returns. It’s completely free and run directly by the IRS rather than third-party software companies.

VITA and TCE Programs: The Volunteer Income Tax Assistance (VITA) program offers free tax preparation for people who earn $67,000 or less, people with disabilities, and limited English speakers. The Tax Counseling for the Elderly (TCE) program specializes in helping taxpayers 60 and older with questions about pensions and retirement.

MilTax: Active duty military, reservists, and veterans can use the Department of Defense’s MilTax program for free federal and state tax preparation.

Changes That Affect 2025 Returns

Several significant changes affect returns filed in 2026:

Higher Standard Deduction: The standard deduction for 2025 returns is $30,000 for married couples filing jointly, $15,000 for single filers and married filing separately, and $22,500 for heads of household. These amounts increased due to inflation adjustments.

Increased Child Tax Credit: The child tax credit rises to $2,200 per qualifying child under 17 for 2025 returns, up from the previous amount. This is part of the One, Big, Beautiful Bill provisions.

New Deductions on Schedule 1-A: You’ll see a new Schedule 1-A if you’re claiming any of the recently enacted deductions, including the no-tax-on-tips provision, the no-tax-on-overtime provision, or the car loan interest deduction.

Digital Asset Reporting: If you bought, sold, or received cryptocurrency, stablecoins, or NFTs during 2025, you must answer the digital asset question on Form 1040 and report any related income, gains, or losses. Some taxpayers may receive Form 1099-DA from brokers for the first time.

Paper Check Phase-Out: The IRS has largely phased out paper tax refund checks as of September 30, 2025. Most taxpayers must now provide bank routing and account numbers for direct deposit to receive their refunds.

How to Get Your Refund Faster

The IRS consistently emphasizes that the fastest way to get your refund is to file electronically and choose direct deposit. Most e-filed returns with direct deposit receive refunds within 21 days. Paper returns can take six to eight weeks or longer.

To track your refund status, use the IRS “Where’s My Refund?” tool on IRS.gov or the IRS2Go mobile app. You can check your status 24 hours after e-filing or about four weeks after mailing a paper return.

If you’re claiming the Earned Income Tax Credit or Additional Child Tax Credit, expect a slight delay. By law, the IRS cannot issue refunds for returns claiming these credits until mid-February at the earliest, regardless of when you file.

Key Takeaways

Tax season 2026 starts on January 26, 2026, with returns due by April 15, 2026. If you have a straightforward return and income under $84,000, you can file for free through IRS Free File starting January 9. Several new deductions from the One, Big, Beautiful Bill may apply to your situation, so look into whether you qualify for the no-tax-on-tips, overtime, or car loan interest deductions.

Gather your documents now so you’re ready to file as soon as your W-2s and 1099s arrive. The sooner you file, the sooner you’ll receive any refund you’re owed, and you’ll have more time to address any issues that arise.

Sources

- IRS announces first day of 2026 filing season - Internal Revenue Service

- What taxpayers can do to Get Ready for the 2026 tax filing season - Internal Revenue Service

- Important Tax Dates and Deadlines in 2026 - TaxAct