What tax moves should you make before December 31? The most impactful year-end tax strategies include maximizing retirement account contributions, harvesting investment losses to offset gains, bunching itemized deductions if you’re near the standard deduction threshold, spending remaining FSA funds, and making qualified charitable distributions from IRAs if you’re over 70½. These strategies must be completed by December 31 to count for the current tax year, with the exception of IRA contributions, which can be made until the April filing deadline.

Year-end tax planning is about timing. Many deductions and credits depend on when money leaves your account, not when services are rendered. With some strategic moves in December, you can significantly reduce your tax burden.

This article provides general information and is not tax advice. Consult a tax professional for guidance specific to your situation.

Max Out Retirement Contributions

Retirement contributions are the most powerful tax-reduction tool available to most people. Contributions to traditional 401(k)s, 403(b)s, and similar employer plans reduce your taxable income dollar for dollar, up to annual limits.

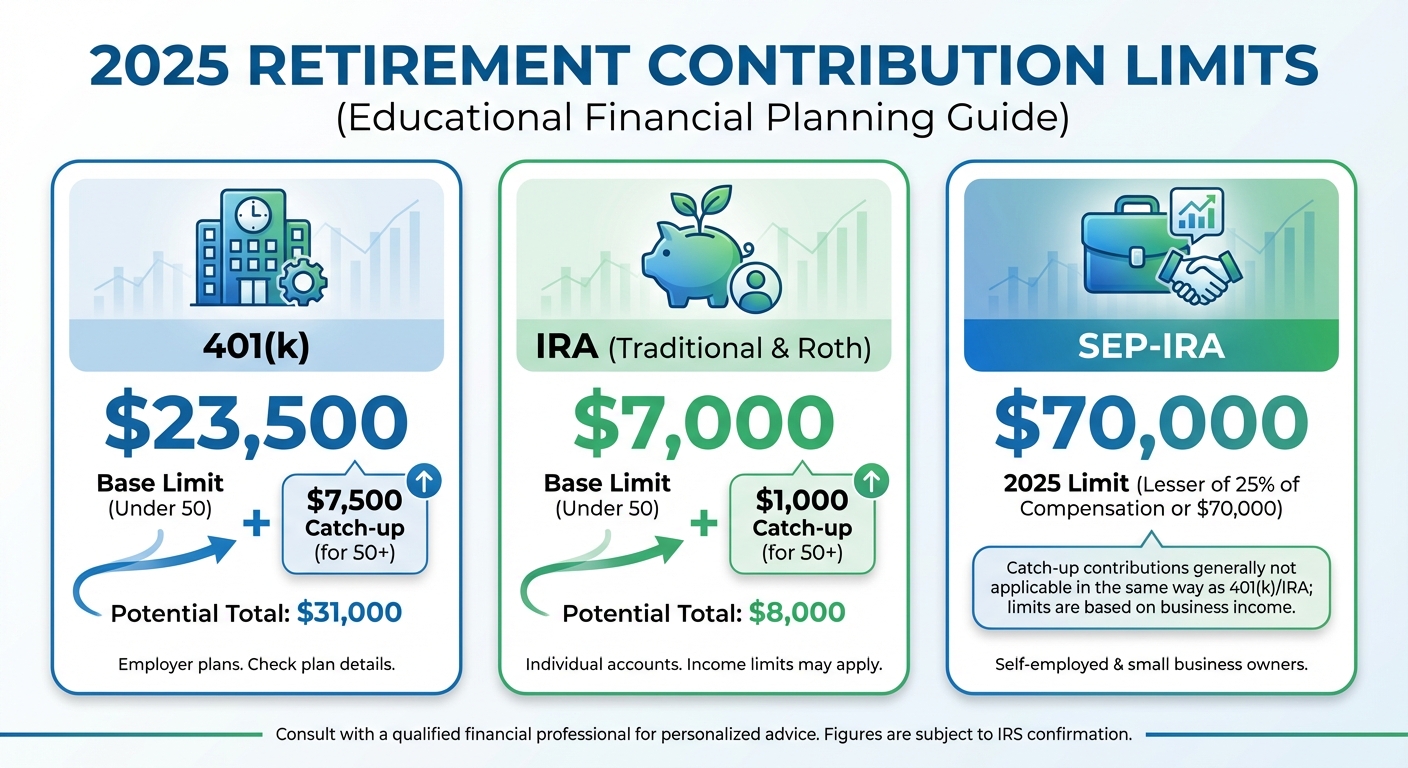

For 2025, the 401(k) contribution limit is $23,500 for those under 50 and $31,000 for those 50 and older, including the catch-up contribution. Check your year-to-date contributions and calculate whether you can increase your remaining paycheck deferrals to get closer to the maximum. Contact your HR or payroll department quickly, as changes may take a pay period or two to process.

Traditional IRA contributions also reduce taxable income for those who qualify based on income and workplace retirement plan coverage. You have until April 15, 2026, to make 2025 IRA contributions, but contributing before year-end means your money starts growing tax-advantaged sooner.

If you’re self-employed, SEP-IRA and Solo 401(k) plans allow substantially higher contributions. A SEP-IRA allows contributions up to 25 percent of net self-employment income or $70,000, whichever is less. These contributions can also be made until your tax filing deadline, including extensions.

Harvest Investment Losses

Tax-loss harvesting means selling investments that have declined in value to realize losses that offset taxable gains. If your investment losses exceed your gains, you can deduct up to $3,000 of excess losses against ordinary income, carrying forward any remainder to future years.

Review your taxable brokerage accounts for positions with unrealized losses. Consider selling losers to offset gains you’ve realized earlier in the year, particularly short-term gains, which are taxed at higher ordinary income rates. Be mindful of the wash-sale rule: if you repurchase a substantially identical investment within 30 days before or after the sale, you cannot claim the loss.

The wash-sale rule doesn’t prevent you from staying invested in the market. You can immediately purchase a similar but not identical investment, such as selling one S&P 500 index fund and buying a different one or a total market fund. This maintains your market exposure while capturing the tax benefit.

Consider Bunching Itemized Deductions

The standard deduction for 2025 is $15,000 for single filers and $30,000 for married couples filing jointly. Many taxpayers have itemized deductions that fall slightly below these thresholds, making the standard deduction more beneficial.

Bunching involves concentrating deductions into alternating years to exceed the standard deduction threshold. If you’re close to the threshold this year, consider prepaying property taxes (if your state allows), scheduling medical procedures you’ve been postponing, or making larger charitable contributions now while taking the standard deduction next year.

For charitable giving specifically, donor-advised funds offer a powerful bunching tool. You can contribute a large amount in one year, take the full deduction, then distribute grants to charities over multiple future years. This gives you the tax benefit of a large contribution while maintaining steady support for organizations you care about.

Use or Lose FSA Funds

Flexible Spending Accounts require that you spend funds by the end of the plan year or forfeit them. Some plans offer a grace period of up to two and a half months into the following year, while others allow carrying over up to $640 into the next year. Check your plan’s specific rules.

If you have remaining healthcare FSA funds, schedule end-of-year medical appointments, order prescription refills, purchase new eyeglasses or contacts, or stock up on eligible medical supplies. Many expenses you might not realize are FSA-eligible include sunscreen, first aid supplies, and over-the-counter medications.

Dependent care FSA funds are harder to spend quickly since they require actual dependent care expenses. If you have remaining funds, check if your provider can accept prepayment for January care or whether you have outstanding invoices from earlier in the year.

Make Strategic Charitable Contributions

If you itemize deductions, charitable contributions made by December 31 count for this year’s taxes. Cash donations to public charities are generally deductible up to 60 percent of adjusted gross income.

Donating appreciated stock or mutual fund shares can be more tax-efficient than giving cash. You receive a deduction for the full fair market value while avoiding capital gains tax on the appreciation. This works best for assets held longer than one year with significant unrealized gains.

If you’re over 70½ and have a traditional IRA, qualified charitable distributions allow you to transfer up to $105,000 directly to charities. These distributions count toward required minimum distributions but aren’t included in taxable income, providing a tax benefit even if you don’t itemize.

Review Capital Gains and Losses

Beyond tax-loss harvesting, consider your overall capital gains situation. If you’re in the 0 percent capital gains bracket (taxable income below $47,025 for singles or $94,050 for married couples filing jointly in 2025), you might benefit from intentionally realizing gains to reset your cost basis at no tax cost.

Conversely, if you have unavoidable large gains this year, look for additional losses to harvest or consider whether timing income or deductions can reduce the tax impact. Bunching deductions into a high-gain year makes those deductions more valuable.

For mutual fund investors, check for anticipated year-end capital gains distributions. If you’re planning to invest new money, consider waiting until after the distribution date to avoid receiving a taxable distribution immediately.

Summary

Key year-end tax moves include maximizing retirement contributions before December 31 (except for IRAs, which have until April 15), harvesting investment losses to offset gains, bunching itemized deductions if you’re near the standard deduction threshold, and spending FSA funds before they expire.

Charitable contributions must be made by December 31 to count for this tax year, and donating appreciated stock offers double tax benefits. Review your overall tax picture, including capital gains, and consider whether any income or expense timing adjustments could reduce your burden. When in doubt, consult a tax professional before year-end while there’s still time to act.