If you receive Social Security benefits, you’ve probably noticed the annual adjustment that changes your monthly payment each January. For 2026, that adjustment, called the Cost of Living Adjustment or COLA, is 2.8%. For the average retired worker, that translates to about $56 more per month, bringing the average monthly benefit to approximately $1,976.

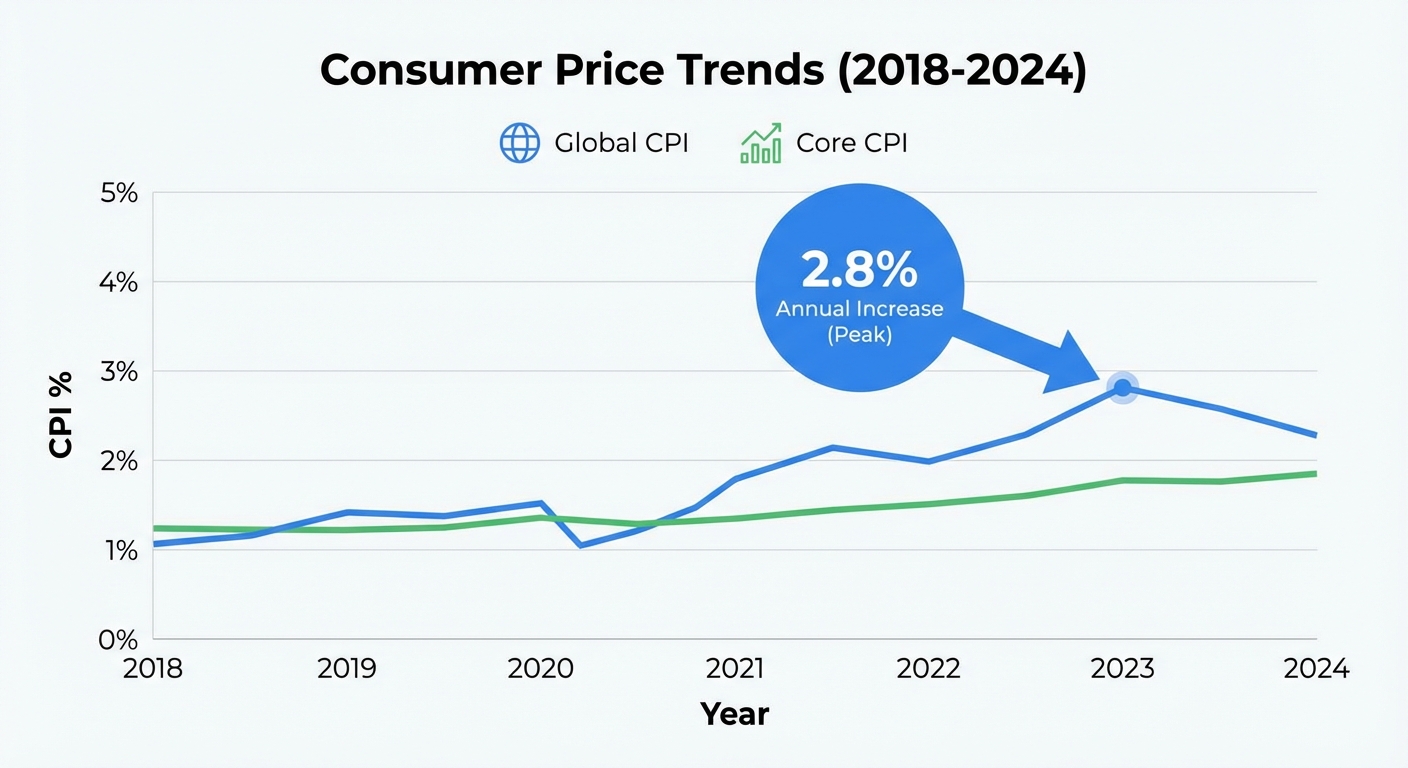

The 2.8% increase is slightly higher than the 2.5% adjustment in 2025, though it remains below the 10-year average of 3.1%. After several years of larger increases driven by high inflation (including the notable 8.7% jump in 2023), this year’s COLA reflects a return toward more typical adjustments as inflation has cooled.

How the COLA Is Calculated

The Social Security Administration doesn’t pick the COLA number arbitrarily. It’s based on a specific inflation measure called the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA compares the average CPI-W from the third quarter of the current year to the same period of the previous year.

If prices went up, benefits go up by the same percentage. If prices somehow went down (deflation), benefits stay flat rather than decreasing. This formula is set by law, meaning the annual adjustment happens automatically without Congress needing to vote on it.

The CPI-W tracks the prices of goods and services that typical urban wage earners and clerical workers purchase, including food, housing, transportation, medical care, and other expenses. Critics sometimes argue that this index doesn’t fully capture the spending patterns of retirees, who often spend more on healthcare than working-age adults. However, it remains the official measure for calculating the annual adjustment.

What the 2026 COLA Means in Dollars

The percentage increase applies to your current benefit amount, so the actual dollar change varies depending on what you receive. Here’s how the 2.8% increase translates for different benefit levels:

| Current Monthly Benefit | 2026 Increase | New Monthly Benefit |

|---|---|---|

| $1,000 | $28 | $1,028 |

| $1,500 | $42 | $1,542 |

| $1,920 (average) | $54 | $1,974 |

| $2,500 | $70 | $2,570 |

| $3,000 | $84 | $3,084 |

The maximum Social Security benefit for someone retiring at full retirement age in 2026 is $4,018 per month, which would see an increase of approximately $112.

Keep in mind that your net increase might be smaller than these numbers suggest. If you have Medicare Part B premiums deducted from your Social Security check, any increase in those premiums will offset part of your COLA. For 2026, the standard Medicare Part B premium is $185 per month, up from $174.70 in 2025.

When the New Amount Takes Effect

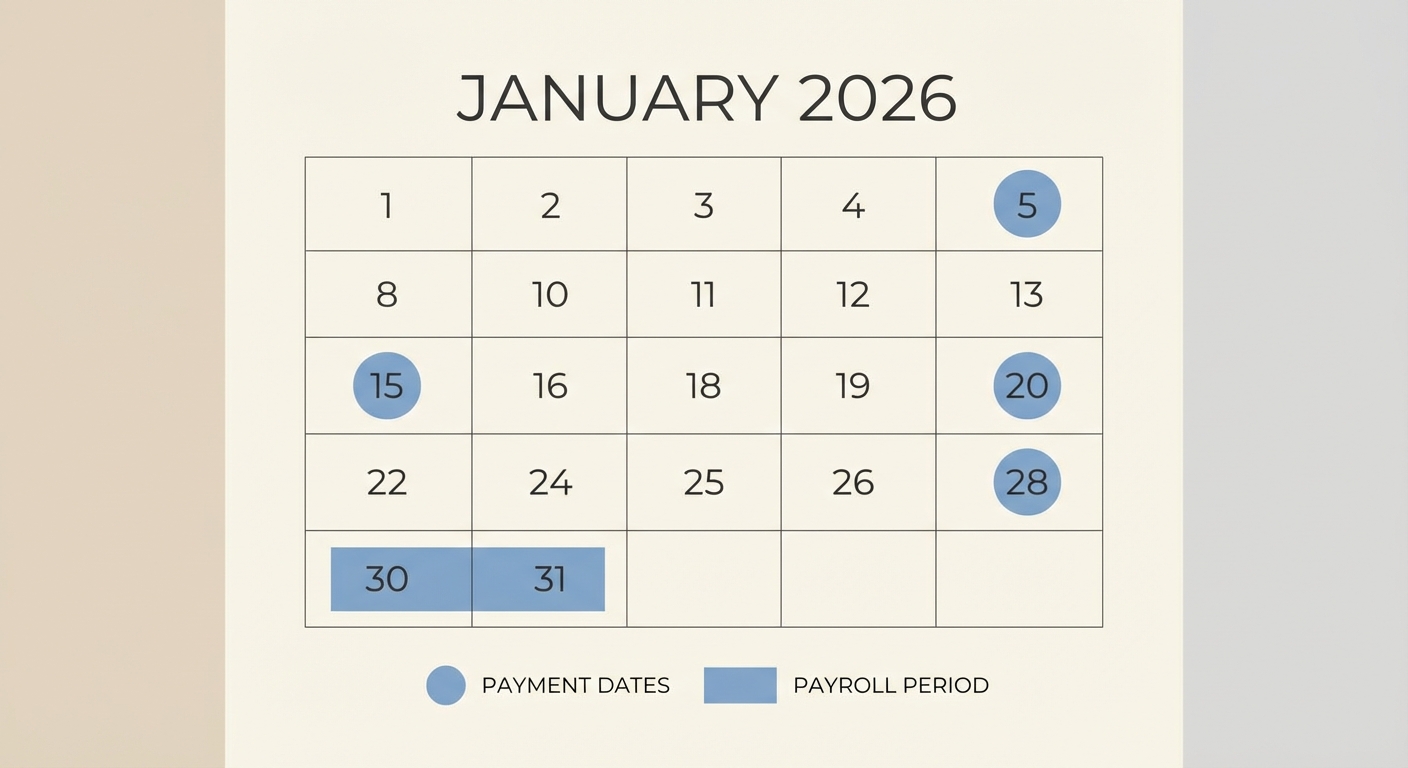

The 2026 COLA applies to benefits starting with the January 2026 payment. However, the date you actually receive your payment depends on your birth date:

- Born on the 1st-10th: Payment arrives on the second Wednesday of each month

- Born on the 11th-20th: Payment arrives on the third Wednesday of each month

- Born on the 21st-31st: Payment arrives on the fourth Wednesday of each month

For January 2026, this means payments will arrive on January 8th, 15th, or 22nd depending on your birth date. If you receive both Social Security and Supplemental Security Income (SSI), the SSI portion typically arrives on the first of the month.

You should have received a notice from the Social Security Administration in December 2025 detailing your new benefit amount. If you didn’t receive it or want to verify your new amount, you can check your my Social Security account online at ssa.gov.

How 2026 Compares to Recent Years

The 2026 COLA falls within the normal historical range after several unusual years:

| Year | COLA Percentage |

|---|---|

| 2026 | 2.8% |

| 2025 | 2.5% |

| 2024 | 3.2% |

| 2023 | 8.7% |

| 2022 | 5.9% |

| 2021 | 1.3% |

The 8.7% increase in 2023 was the largest in over 40 years, reflecting the spike in inflation during 2022. As inflation has moderated, the annual adjustments have returned to more typical levels. The Congressional Budget Office projects inflation will continue cooling toward the Federal Reserve’s 2% target, which would likely mean similar or slightly smaller COLAs in future years.

Does the COLA Keep Pace with Your Expenses?

This is where many beneficiaries express frustration. While the COLA is designed to maintain purchasing power, some argue it doesn’t fully reflect the reality of living on a fixed income, particularly for older Americans.

Healthcare costs, which tend to rise faster than general inflation and represent a larger portion of retiree spending, are a frequent concern. Similarly, housing costs in many areas have outpaced the general inflation index. The CPI-W measure weights these categories based on the spending patterns of urban wage earners, not retirees specifically.

Some policy researchers have proposed using a different index, the CPI-E (Consumer Price Index for the Elderly), which weights healthcare and housing more heavily. Studies suggest this measure would produce slightly higher annual adjustments, but Congress has not adopted it.

For now, the 2.8% increase is what’s on the table. If you’re finding that your benefits aren’t keeping pace with your actual expenses, our article on how to create a budget that sticks offers strategies for making your income go further.

Key Takeaways

The 2026 Social Security COLA is 2.8%, translating to about $56 more per month for the average beneficiary. The increase is calculated automatically based on inflation data and took effect with January 2026 payments. While it’s a slightly larger increase than 2025, it remains modest compared to the high-inflation adjustments of 2022 and 2023.

Your actual increase depends on your current benefit amount, and Medicare premium changes may offset some of the gain. To see your exact new benefit amount, log into your my Social Security account at ssa.gov or review the notice that was mailed in December.

Sources

- Social Security Administration 2026 COLA announcement

- Congressional Budget Office inflation projections

- Centers for Medicare & Medicaid Services 2026 premium announcements