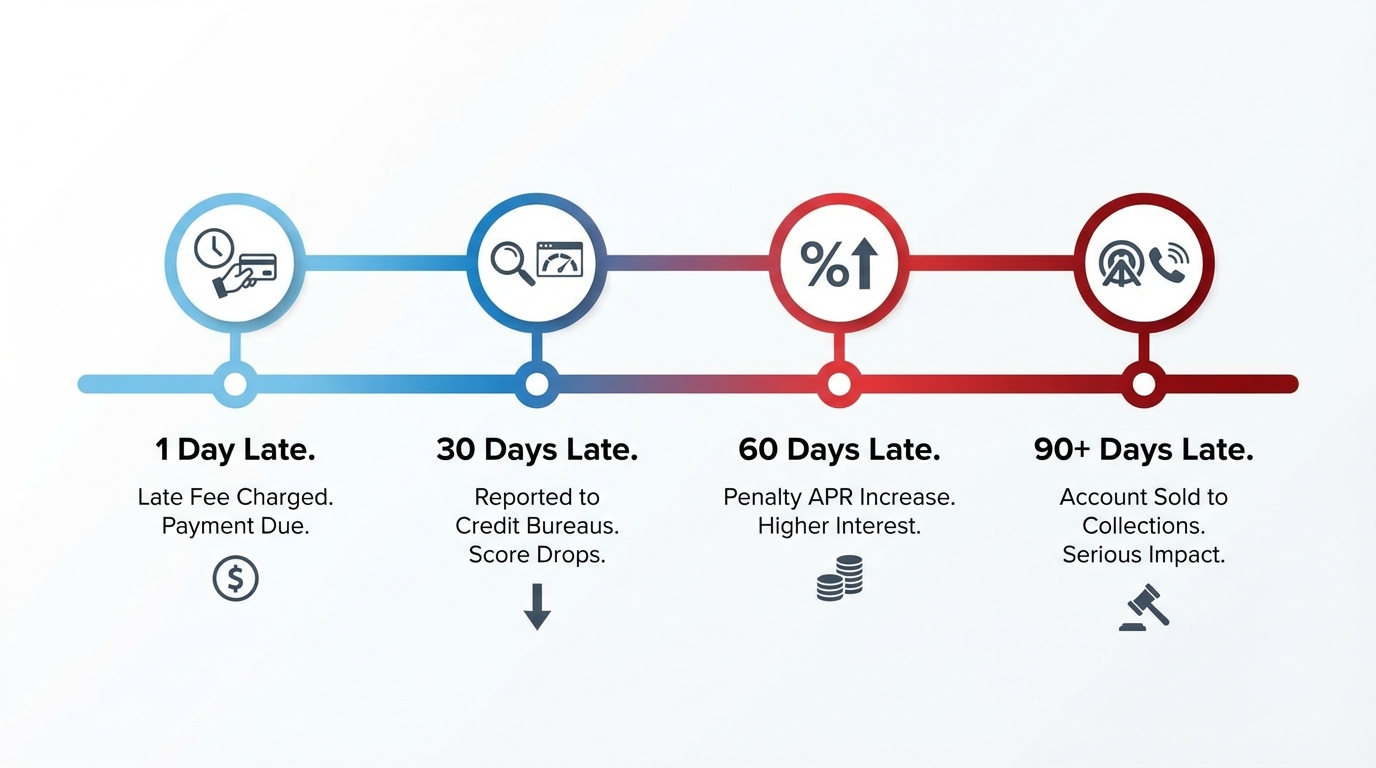

Missing a credit card payment isn’t the end of the world, but the consequences escalate the longer you wait. A payment that’s a few days late typically results in a late fee but no credit damage. A payment that’s 30 or more days late gets reported to credit bureaus and can significantly hurt your credit score.

The good news is that you have some time before the most serious consequences kick in, and taking action quickly can minimize the damage. Here’s exactly what happens at each stage.

The First Few Days: Late Fee Territory

If your payment is due on the 15th and you pay on the 18th, you’ll likely see a late fee on your next statement. Federal law caps late fees at $32 for the first offense and $43 for subsequent late payments within six billing cycles (these amounts are adjusted annually for inflation).

However, your credit score won’t be affected yet. Credit card companies don’t report late payments to credit bureaus until you’re at least 30 days past due. This means a payment that’s a few days or even a couple weeks late, while annoying and costly, won’t show up on your credit report.

Some credit card issuers waive the first late fee if you have a history of on-time payments. It’s worth calling customer service and asking, especially if this is your first time missing a payment. The worst they can say is no.

30 Days Late: Credit Report Impact

Once your payment is 30 days past due, things get more serious. The credit card company will report the late payment to the three major credit bureaus: Equifax, Experian, and TransUnion. This is where the real damage begins.

A single 30-day late payment can cause your credit score to drop by 60 to 110 points, depending on your starting score and credit history. Ironically, people with higher credit scores often see larger drops because they have more to lose, and lenders view the late payment as more out of character.

This late payment notation stays on your credit report for seven years from the date of the missed payment. The impact on your score lessens over time, especially if you resume making on-time payments, but the mark remains visible to anyone who pulls your credit.

At this stage, you may also start receiving calls and emails from your credit card company’s collections department. These are typically internal collection efforts, not third-party collectors, and the tone is usually focused on getting you to make a payment rather than threatening legal action.

60 Days Late: Penalty APR

If you reach 60 days past due, your credit card issuer can impose a penalty APR, which is typically the highest rate the card allows, often around 29.99%. This penalty rate can apply not just to new purchases but to your entire existing balance.

The credit bureaus also update your record to show a 60-day late payment, which is viewed more negatively than a 30-day late. Your credit score takes another hit, and the notation on your report reflects the increased severity.

By this point, you’ve likely accumulated multiple late fees and at least one billing cycle’s worth of interest charges. The minimum payment required may have increased, and getting caught up becomes more expensive with each passing day.

90+ Days Late: Charge-Off Territory

If your account remains unpaid for 120 to 180 days (the exact timing varies by issuer), the credit card company will likely “charge off” the account. A charge-off doesn’t mean you no longer owe the money. It’s an accounting term meaning the company has written off the debt as a loss on their books.

After a charge-off, the account is typically sold to a third-party debt collection agency for pennies on the dollar. The collection agency then attempts to recover the debt from you. At this point, you’ll have two negative items on your credit report: the original charged-off account and the new collection account.

Collections calls can be persistent and stressful. However, you have rights under the Fair Debt Collection Practices Act, including the right to request that collectors only contact you in writing and restrictions on when and how they can call you.

How to Minimize the Damage

If you’ve missed a payment, here’s what to do:

Make the payment immediately. Even if you can’t pay the full amount, paying something demonstrates good faith and may prevent the situation from escalating. Paying before 30 days eliminates the credit bureau reporting.

Call your credit card issuer. Explain the situation and ask if they’ll waive the late fee, especially if you have a good payment history. If you’re facing financial hardship, ask about hardship programs that may temporarily reduce your interest rate or minimum payment.

Set up autopay for at least the minimum. This prevents future missed payments. You can always pay more manually, but autopay ensures you never accidentally miss a due date again.

Check your credit report. If the late payment was reported, verify that the information is accurate. If there’s an error, you can dispute it with the credit bureaus. Our article on how to improve your credit score fast covers next steps for rebuilding.

Key Takeaways

Missing a credit card payment triggers late fees immediately, but the more serious consequences, credit damage and penalty rates, don’t kick in until you’re 30 or 60 days late. Pay as soon as you realize you’ve missed a payment to minimize the impact. If you’re struggling to make payments, contact your issuer about hardship options before your account becomes severely delinquent.

A single late payment isn’t catastrophic, but it’s a signal to examine your payment systems and make sure it doesn’t happen again.