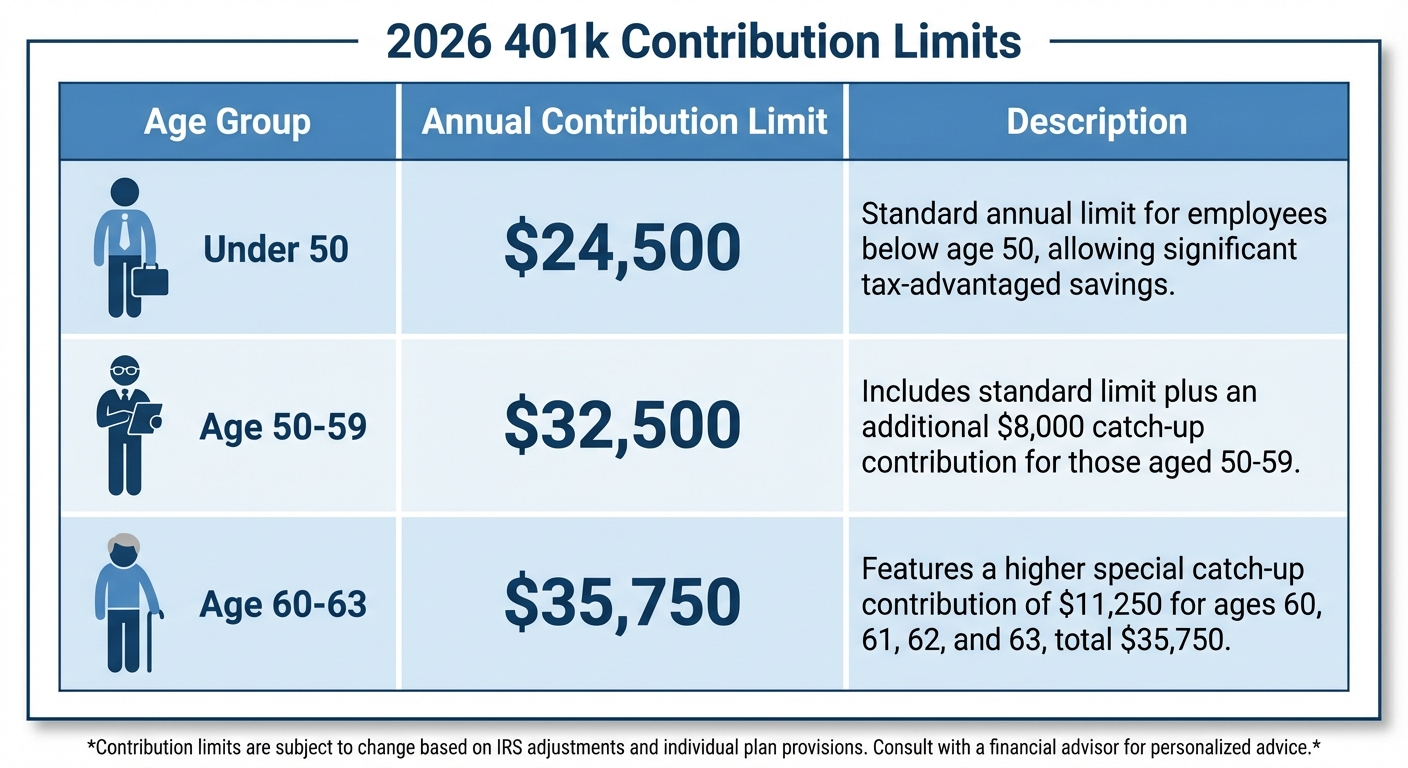

How much can you contribute to a 401k in 2026? The standard contribution limit is $24,500 for employee deferrals. If you’re 50 or older, you can add an extra $8,000 in catch-up contributions, bringing your total to $32,500. And thanks to the SECURE 2.0 Act, workers aged 60 through 63 get an enhanced catch-up of $11,250, allowing a maximum contribution of $35,750.

These limits apply to the money you defer from your paycheck into your 401(k). They don’t include your employer’s matching contributions, which have a separate combined limit. If you’re trying to maximize your retirement savings, understanding how these limits work together with your employer’s 401k match is essential for getting the most from your retirement plan.

2026 401k Contribution Limits at a Glance

The IRS adjusts 401(k) limits annually based on inflation. Here’s how the numbers break down for 2026:

Standard employee contribution: $24,500

Age 50+ catch-up contribution: $8,000 (total: $32,500)

Ages 60-63 enhanced catch-up: $11,250 (total: $35,750)

Overall limit (employee + employer): $70,000 (or $77,250 with age 50+ catch-up)

The standard limit increased by $1,000 from 2025’s $23,500 limit. The catch-up contribution for those 50 and older increased from $7,500 to $8,000. The new enhanced catch-up for workers in their early 60s is a SECURE 2.0 provision that took effect this year.

How the New 60-63 Catch-Up Works

SECURE 2.0 introduced a special catch-up provision that took effect January 1, 2025, and continues into 2026. If you turn 60, 61, 62, or 63 at any point during 2026, you qualify for the enhanced $11,250 catch-up instead of the standard $8,000 catch-up. Once you turn 64, you revert to the standard catch-up amount.

This provision recognizes that many workers in their early 60s are in their peak earning years and may need to accelerate retirement savings. The four-year window provides an opportunity to contribute an additional $12,500 over what you could contribute at ages 50-59 (over four years compared to the standard catch-up).

The eligibility is based on your age at any point during the calendar year. If you turn 60 in December 2026, you qualify for the entire 2026 enhanced catch-up. If you turn 64 in January 2026, you’re back to the standard catch-up for the whole year. Plan your contributions accordingly, especially if you’re approaching one of these age thresholds.

Roth 401k Catch-Up Requirements for High Earners

Starting in 2026, catch-up contributions face new rules for high earners due to SECURE 2.0. If you earned more than $150,000 in 2025, any catch-up contributions you make in 2026 must go into a Roth 401(k) account. You can no longer make pre-tax catch-up contributions.

This applies specifically to catch-up contributions, not your base $24,500 contribution. You can still make pre-tax contributions up to the standard limit regardless of income. The Roth requirement only kicks in for the additional catch-up amount once you exceed the income threshold.

The $150,000 threshold is based on FICA wages from the prior year, which for 2026 contributions means your 2025 W-2 wages. If you earned $145,000 in 2025 but expect to earn $160,000 in 2026, you can still make pre-tax catch-up contributions in 2026 because the threshold looks backward. If your employer doesn’t offer a Roth 401(k) option, they had until 2026 to add one to comply with this requirement.

Maximizing Your 401k in 2026

Hitting the maximum contribution requires planning, especially if your income doesn’t easily support saving $24,500 or more annually. The math works out to roughly $942 per paycheck if you’re paid biweekly and want to reach the standard limit.

Check your current contribution rate early in the year. If you’re contributing a percentage of your salary, a raise might automatically increase your contributions. Conversely, if you set a flat dollar amount, you might need to adjust it to hit the new limits.

Front-loading vs. spreading contributions is a strategic choice. Some plans allow you to contribute heavily early in the year and hit your limit quickly. Others require spreading contributions evenly. Front-loading gets your money invested sooner, but spreading ensures you capture employer match contributions throughout the year if your match is calculated per-paycheck.

True-up provisions matter if you front-load. Some employers offer a “true-up” at year-end to provide matching contributions you might have missed by maxing out early. Check your plan documents or ask HR whether your plan includes this feature before deciding on a contribution schedule.

Understanding how compound interest works helps illustrate why maximizing contributions matters. An extra $1,000 contributed at age 30, earning 7% average annual returns, becomes roughly $14,000 by age 65. The value of maximizing early and consistently compounds dramatically over a career.

What Doesn’t Count Toward the $24,500 Limit

Several types of contributions have separate limits and don’t reduce your $24,500 employee deferral space:

Employer matching contributions don’t count toward your personal limit. If your employer matches 50% up to 6% of your salary, that match is additional free money on top of what you contribute. The combined employer-plus-employee limit is $70,000 for 2026 ($77,250 with catch-up contributions).

After-tax contributions (not Roth) are a separate category available in some plans. These go into a traditional after-tax account and can later be converted to Roth through the “mega backdoor Roth” strategy. The combined limit of $70,000 includes these after-tax contributions.

Rollover contributions from previous employers’ plans or IRAs don’t count against any limit. You can roll over any amount at any time without affecting your current-year contribution room.

Planning for Future Increases

The IRS typically announces the following year’s limits in late October or early November. Contribution limits generally increase by $500 to $1,000 per year, though the exact amount depends on inflation adjustments. The limits can only go up or stay flat; they never decrease.

If you’re several years from retirement, planning for gradually increasing limits helps set realistic savings goals. A 30-year-old who contributes the maximum every year for 35 years, assuming limits increase by roughly $500 annually on average, would contribute over $1.2 million before any investment growth. Factor in compound interest and employer matching, and the retirement account balance could exceed $3-4 million.

The key is starting now with whatever you can contribute, then increasing your contribution rate whenever you get a raise or whenever limits increase. Even if you can’t hit the maximum today, getting as close as possible and increasing annually puts you on track for a secure retirement.

Summary

The 401(k) contribution limit for 2026 is $24,500 for standard contributions, with catch-up options bringing the total to $32,500 for those 50 and older, or $35,750 for workers aged 60-63. High earners making over $150,000 must now direct catch-up contributions to Roth accounts. These limits don’t include employer matching, which has a separate combined cap of $70,000.

Review your contribution elections early in the year to take advantage of the increased limits. If you’re approaching age 50, 60, or 64, pay attention to how age-based catch-up rules affect your maximum contribution. Maximizing your 401(k) contributions, especially with employer matching, remains one of the most powerful wealth-building tools available to American workers.