What is the standard deduction for 2026? The amounts are $32,200 for married couples filing jointly, $16,100 for single filers, $16,100 for married filing separately, and $24,150 for heads of household. These figures come from the One Big Beautiful Bill Act (OBBBA) signed in July 2025, which made the higher standard deduction amounts permanent and adjusted them for inflation.

These deductions reduce your taxable income before the IRS calculates what you owe. If you’re a single filer who earned $60,000, taking the standard deduction means you’re only taxed on $43,900. For most taxpayers, the standard deduction exceeds the total of itemized deductions they could claim, making it the better choice. About 90% of taxpayers now use the standard deduction rather than itemizing.

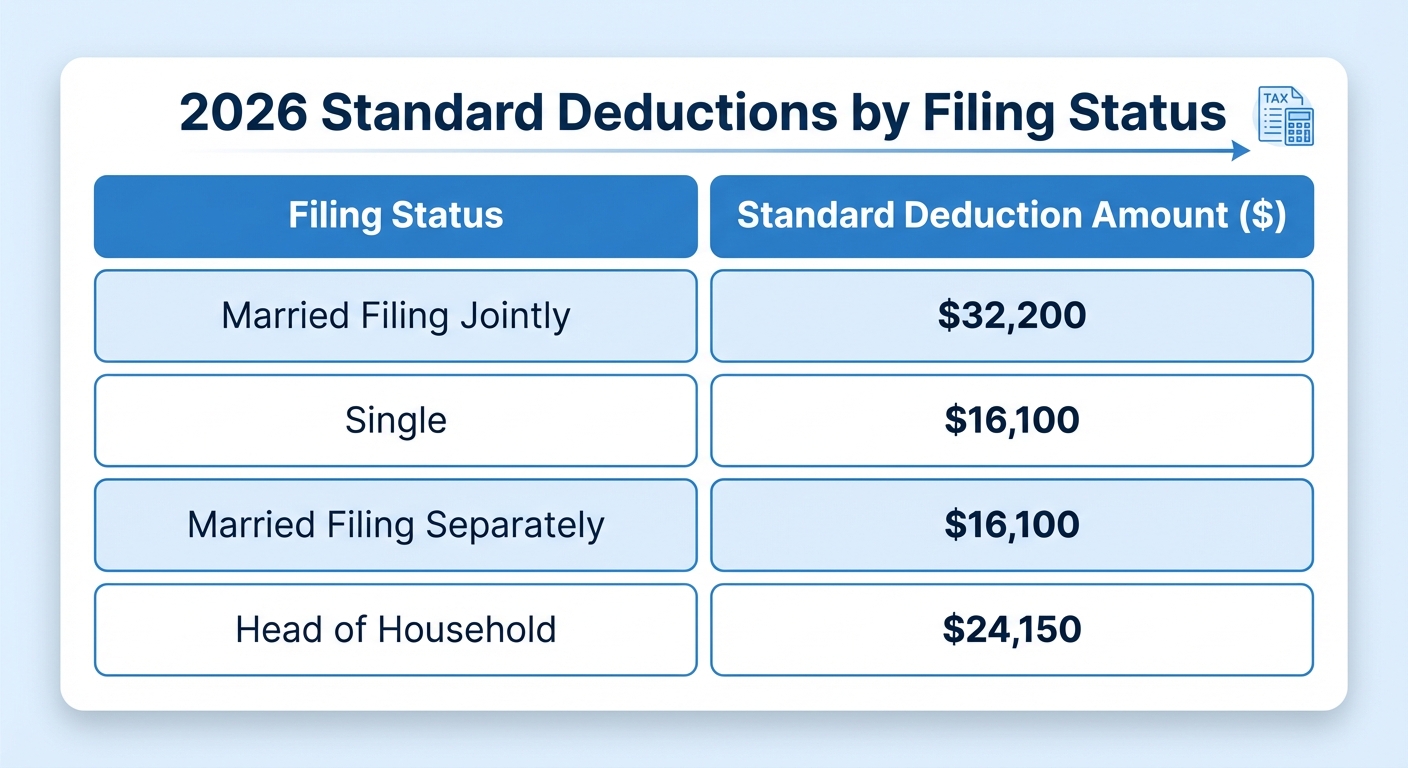

2026 Standard Deduction by Filing Status

The IRS sets different standard deduction amounts based on how you file your taxes. Here’s what applies for tax year 2026 (the return you’ll file in 2027):

Married Filing Jointly: $32,200

Single: $16,100

Married Filing Separately: $16,100

Head of Household: $24,150

These amounts increased from 2025, when the limits were $31,400 for married filing jointly, $15,700 for single filers, and $23,550 for heads of household. The OBBBA locked in the higher deduction structure that was set to expire after 2025 under the original 2017 tax law, then indexed it for inflation.

The New $6,000 Senior Deduction

The OBBBA introduced a significant new benefit for taxpayers age 65 and older. Starting with tax year 2025 (filed in 2026) and continuing through 2028, eligible seniors can claim an additional $6,000 deduction on top of the standard deduction. For married couples where both spouses are 65 or older, that’s $12,000 extra.

This bonus stacks with the existing additional standard deduction for seniors that was already in the tax code. The existing senior addition for 2026 is $1,600 for single filers and $1,500 per spouse for married filers. Combined with the new $6,000 senior deduction, a single person over 65 could claim a total standard deduction of $23,700 ($16,100 base + $1,600 existing senior + $6,000 new senior).

A married couple both over 65 filing jointly could claim $44,200: the $32,200 base, plus $3,000 for the existing senior additions ($1,500 each), plus $12,000 for the new senior deduction ($6,000 each). This represents a substantial tax reduction for retired and semi-retired filers.

The new senior deduction applies to your filing status based on your age at the end of the tax year. If you turn 65 on December 31, 2026, you qualify for the full deduction. The IRS considers you 65 on the day before your 65th birthday for tax purposes, so someone born on January 1, 1962 would actually be considered 65 for all of 2026.

Standard Deduction vs. Itemizing

The standard deduction is a fixed amount that reduces your taxable income without requiring documentation. Itemizing requires you to list individual deductible expenses and keep records proving each one. You can only choose one method.

Itemized deductions include mortgage interest, state and local taxes (capped at $10,000), charitable contributions, and certain medical expenses that exceed 7.5% of your adjusted gross income. If these add up to more than your standard deduction, itemizing saves you money. If they total less, take the standard deduction.

Most people should take the standard deduction. The higher standard deduction amounts since 2018 mean fewer taxpayers benefit from itemizing. Unless you have substantial mortgage interest, pay high state and local taxes, or make significant charitable donations, the standard deduction likely exceeds your itemizable expenses.

To decide, you’ll need to estimate your itemized deductions. If you own a home, check your mortgage interest statement (Form 1098). Add up property taxes and state income taxes paid, remembering the $10,000 SALT cap. Include charitable donations you can document. If the total exceeds your standard deduction, itemizing makes sense. Tax software walks you through this comparison automatically during filing.

How the Standard Deduction Affects Your Tax Bill

Understanding how deductions work helps clarify their value. The standard deduction reduces your taxable income, not your tax bill directly. The actual tax savings depend on your marginal tax bracket.

If you’re in the 22% tax bracket and take the $16,100 single standard deduction, you save $3,542 in taxes ($16,100 × 0.22). If you’re in the 12% bracket, that same deduction saves you $1,932. Higher-income filers in higher brackets save more in absolute dollars from the same deduction amount.

This is different from tax credits, which reduce your actual tax bill dollar-for-dollar. A $1,000 tax credit saves you $1,000 regardless of your bracket. The standard deduction’s value scales with your income level because it works through bracket math rather than direct subtraction.

Planning around the standard deduction can help maximize your tax refund. If you’re close to the itemizing threshold, bunching deductions into a single year can push you over. For example, doubling up on charitable donations every other year might let you itemize in alternating years while taking the standard deduction in between.

Who Cannot Claim the Standard Deduction

Most taxpayers can claim the standard deduction, but certain situations disqualify you:

Married filing separately when spouse itemizes: If you’re married and filing separately, both spouses must use the same method. If one itemizes, the other must itemize too, even if their itemized deductions are zero.

Nonresident aliens: If you’re a nonresident alien for any part of the year, you generally cannot claim the standard deduction. There are exceptions for certain students and business apprentices from India.

Dual-status aliens: If you’re a dual-status alien (both nonresident and resident during the year), standard deduction rules vary based on your specific situation.

Short tax year filers: If you’re filing a return for a period less than 12 months due to a change in accounting period, the standard deduction may be limited or unavailable.

Estates and trusts: These entities generally cannot claim the standard deduction and must itemize all deductible expenses.

For most American taxpayers filing individual returns, none of these exceptions apply. If you’re unsure whether you qualify, tax software asks the relevant questions and guides you to the correct treatment.

Changes From Previous Years

The OBBBA made the higher standard deduction permanent after it was scheduled to expire at the end of 2025. Under the original 2017 tax law, the standard deduction was set to drop back to approximately $8,000 for single filers and $16,000 for married couples in 2026. That sunset provision no longer applies.

The annual inflation adjustments continue as before. Each fall, the IRS announces the following year’s standard deduction amounts based on inflation calculations. The 2026 amounts increased by approximately 2.5% from 2025, reflecting moderate inflation.

The new $6,000 senior deduction is genuinely new rather than an increase to existing amounts. It runs from 2025 through 2028 under current law, then will need congressional action to extend beyond that window. Seniors should factor this temporary benefit into their tax planning, particularly around decisions like home office deductions and Roth conversions that might be timed around these deduction years.

Summary

The 2026 standard deduction is $32,200 for married filing jointly, $16,100 for single filers, $16,100 for married filing separately, and $24,150 for heads of household. Taxpayers 65 and older can add a new $6,000 senior deduction (per person), plus the existing $1,500-$1,600 additional deduction for seniors.

Most taxpayers benefit from taking the standard deduction rather than itemizing. Compare your potential itemized deductions (mortgage interest, state/local taxes up to $10,000, charitable contributions) to your standard deduction amount. If itemizing doesn’t exceed the standard deduction, take the simpler path. Tax software calculates this automatically and recommends the better option during filing.