How do you set financial goals for the new year? Start by auditing your current situation: net worth, debts, savings rate, and spending patterns. Then set specific, measurable goals prioritized in this order: build an emergency fund, pay off high-interest debt, maximize employer 401(k) matching, and tackle other savings goals. Make goals achievable by automating transfers and breaking large targets into monthly amounts.

Vague resolutions like “save more money” fail because they lack specificity. Effective financial goals include concrete numbers, deadlines, and automatic systems that don’t rely on willpower alone.

Assess Where You Stand

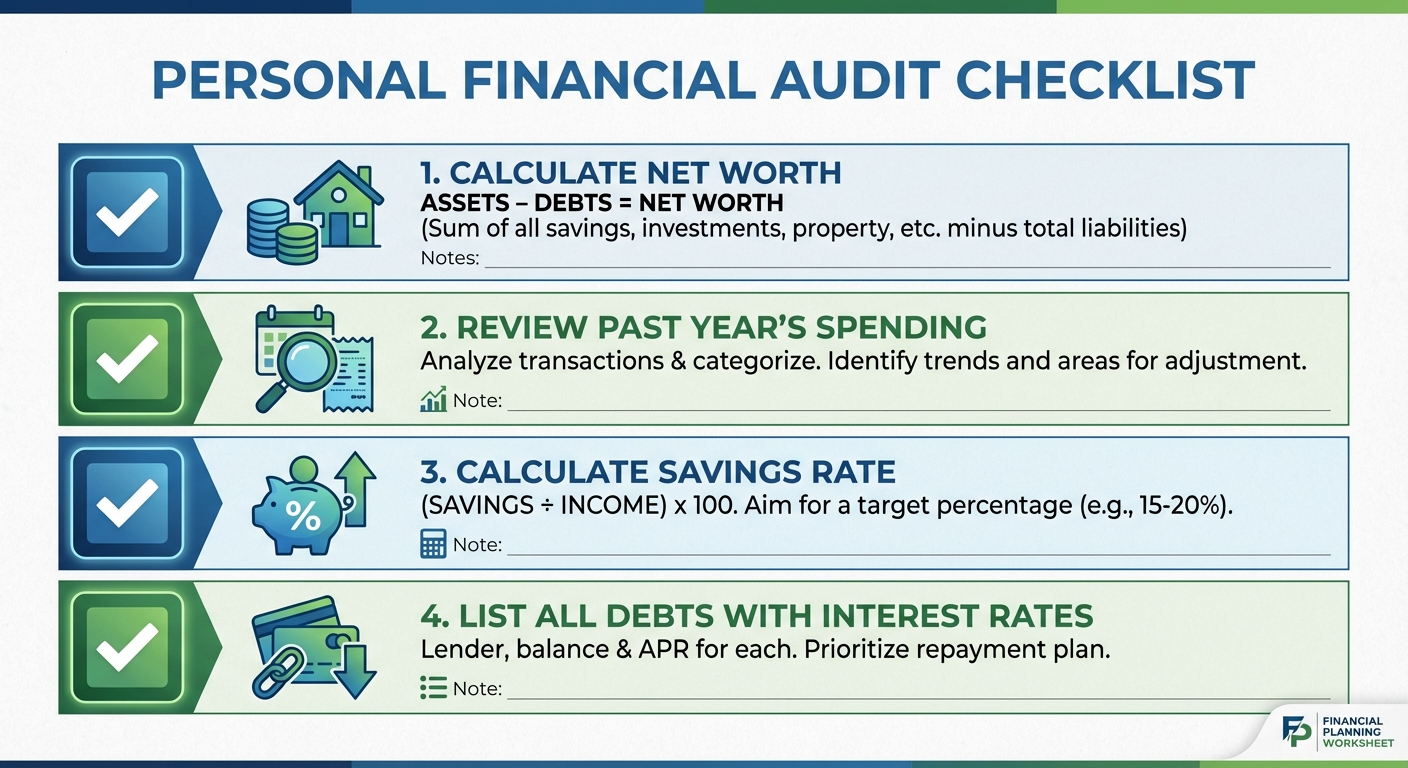

Before setting goals, understand your starting point. Calculate your net worth by listing all assets (savings, investments, home equity, retirement accounts) and subtracting all debts (credit cards, loans, mortgages). This single number measures overall financial health.

Review your spending from the past year. Bank and credit card statements reveal patterns you might not notice otherwise. Identify your largest expense categories and any spending that surprised you.

Calculate your savings rate by dividing annual savings by annual income. If you saved $5,000 on $50,000 income, your savings rate is 10 percent. This metric helps track improvement year over year.

List all debts with their interest rates. High-interest debt (typically anything above 7-8 percent) is an emergency that should be prioritized. Knowing your interest rates helps allocate extra payments effectively.

Prioritize Your Goals Correctly

Financial goals compete for limited resources. Prioritizing correctly ensures you address the most impactful areas first.

Emergency fund first. Before aggressive debt payoff or investment, build three to six months of essential expenses in liquid savings. This buffer prevents new debt when unexpected expenses arise. Without it, one car repair can undo months of progress.

High-interest debt second. Credit card debt at 20 percent interest costs more than most investments can return. Paying it off is effectively a 20 percent guaranteed return. Prioritize debts by interest rate, paying minimums on everything while throwing extra money at the highest-rate balance.

Employer 401(k) match third. If your employer matches retirement contributions, contribute at least enough to capture the full match. A typical 50 percent match on 6 percent of salary is an immediate 50 percent return, free money you shouldn’t leave on the table.

Other goals fourth. After the above priorities, tackle longer-term goals: additional retirement savings, house down payment, college funds, or other objectives. These vary by individual situation and values.

Make Goals Specific and Measurable

Vague goals feel good but achieve little. “Save more” becomes “save $500 per month into a high-yield savings account.” “Pay off debt” becomes “pay an extra $300 monthly toward Visa card until zero balance.”

Each goal should answer: how much, by when, and into what account? “Build a $10,000 emergency fund by December 2026 in my Ally savings account” is actionable. “Have more savings” is not.

Break annual goals into monthly amounts. Saving $6,000 this year means saving $500 per month. This makes progress trackable and the target less overwhelming. Missing one month becomes a specific shortfall to address rather than a failed year.

Write your goals down. Research consistently shows that written goals are more likely to be achieved than mental intentions. Post them somewhere visible if that helps, or review them monthly regardless.

Automate Everything Possible

Willpower is unreliable. The most effective financial systems remove decisions from the equation.

Set up automatic transfers from checking to savings on payday. The money moves before you can spend it. Treat savings like a bill that gets paid first, not like leftovers to be saved if anything remains.

Increase 401(k) contributions through your payroll system. Again, the money is gone before you see it. Automatic escalation features gradually increase your contribution rate each year.

Automate debt payments at amounts higher than the minimum. Set the payment for the day after payday so the money doesn’t sit in checking tempting you.

Use separate accounts for different goals if it helps: one for emergency fund, one for vacation savings, one for car replacement. Some banks and apps make this easy with “buckets” or sub-accounts.

Plan for Obstacles

Anticipate what might derail your goals. If you typically overspend in December, plan for it. If irregular income makes steady saving hard, save percentages rather than fixed amounts.

Build slack into your budget. A plan that requires perfection will fail. Leave room for occasional restaurant meals, unexpected expenses, or months when you just can’t hit the target.

Create accountability. Share goals with a partner or friend. Review progress monthly. Some people benefit from tracking apps; others prefer spreadsheets. Find what works for you.

Plan for windfalls. Decide in advance what percentage of bonuses, tax refunds, or gifts goes toward your financial goals. Without a plan, windfalls evaporate into lifestyle inflation.

Review and Adjust Quarterly

Set calendar reminders to review progress quarterly. Compare actual savings and debt payoff to your targets. Celebrate wins and diagnose shortfalls.

Life changes may require goal adjustments. A job loss, raise, new baby, or major purchase can shift priorities. Flexibility isn’t failure; it’s responsive planning.

As you achieve goals, set new ones. Once your emergency fund is complete, redirect those automatic transfers to retirement or other priorities. Financial progress builds momentum.

Summary

Effective financial goals for the new year start with assessing your current situation: net worth, spending patterns, savings rate, and debt details. Prioritize goals in order: emergency fund, high-interest debt, 401(k) match, then other objectives.

Make each goal specific with concrete amounts, deadlines, and accounts. Break annual targets into monthly amounts. Automate transfers and payments so progress doesn’t depend on willpower. Plan for obstacles and review quarterly to stay on track. Written, specific, automated goals dramatically outperform vague resolutions.