Can you deduct your home office if you work from home? Yes, but only if you’re self-employed, a freelancer, or an independent contractor. If you’re a W-2 employee working remotely, you cannot claim the home office deduction on your federal taxes, even if your employer requires you to work from home and you’ve set up a dedicated office space.

This answer surprises many remote workers who assumed their dedicated workspace would qualify for tax benefits. The distinction matters because millions of Americans work from home but only a fraction can actually claim this deduction. Understanding who qualifies, and how the deduction works if you do, can save you thousands of dollars or prevent a costly audit.

Who Qualifies for the Home Office Deduction

The IRS has specific requirements for claiming a home office deduction, and the most important one is your employment status. Self-employed individuals, freelancers, gig workers, and small business owners can qualify. W-2 employees cannot, regardless of their work-from-home arrangement.

This wasn’t always the case. Before the Tax Cuts and Jobs Act of 2017, employees could deduct unreimbursed business expenses, including home office costs, if they exceeded 2% of their adjusted gross income. That provision was suspended through 2025 and may or may not return in future tax years. For now, if you receive a W-2, the home office deduction isn’t available to you at the federal level.

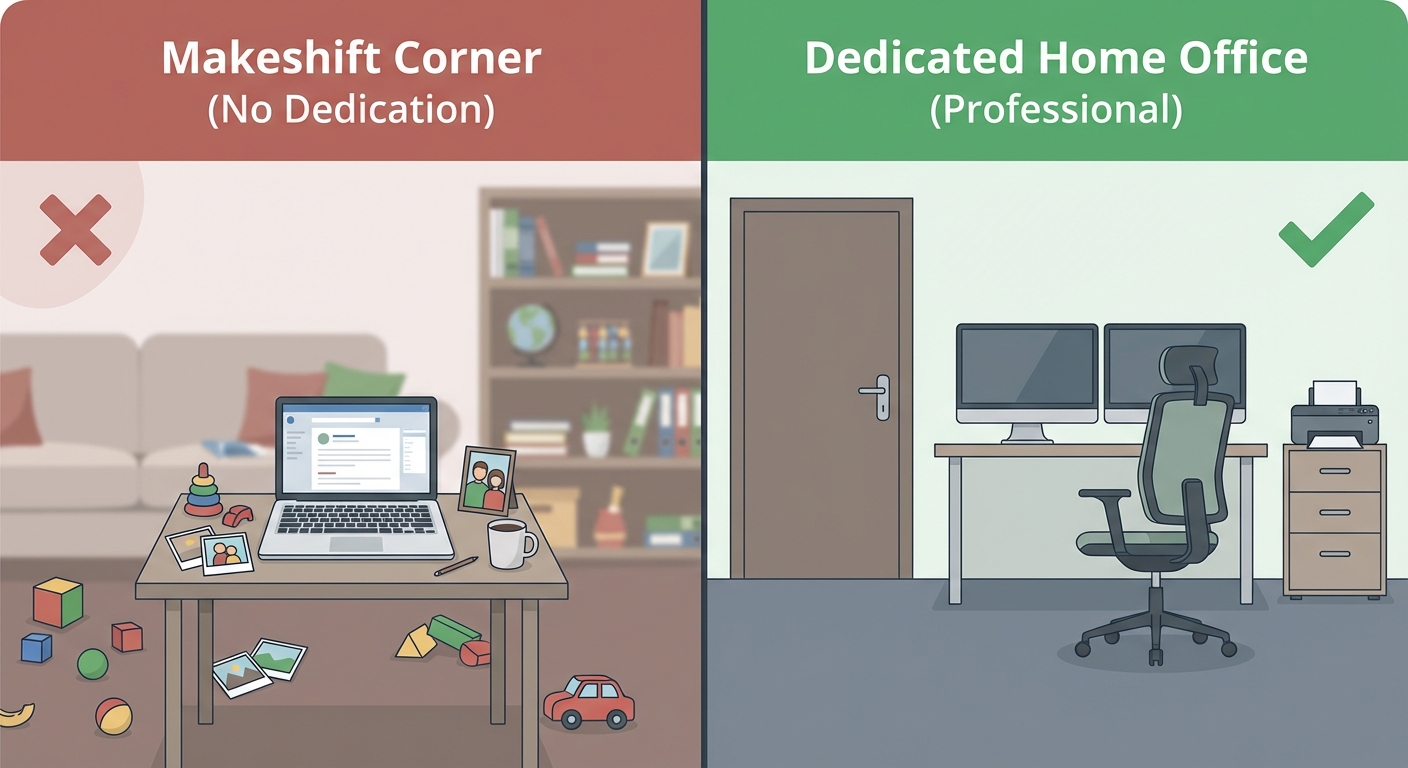

If you’re self-employed, you must meet two additional requirements. First, you must use part of your home exclusively and regularly for business. “Exclusive use” means the space can’t double as a guest room or play area. A desk in your bedroom doesn’t qualify unless that specific area is used only for work. Second, the space must be your principal place of business, where you meet clients, or used for storage of inventory or product samples.

Some states still allow home office deductions for employees. If you live in a state with income tax, it’s worth checking whether your state has different rules than the federal government.

How the Deduction Works

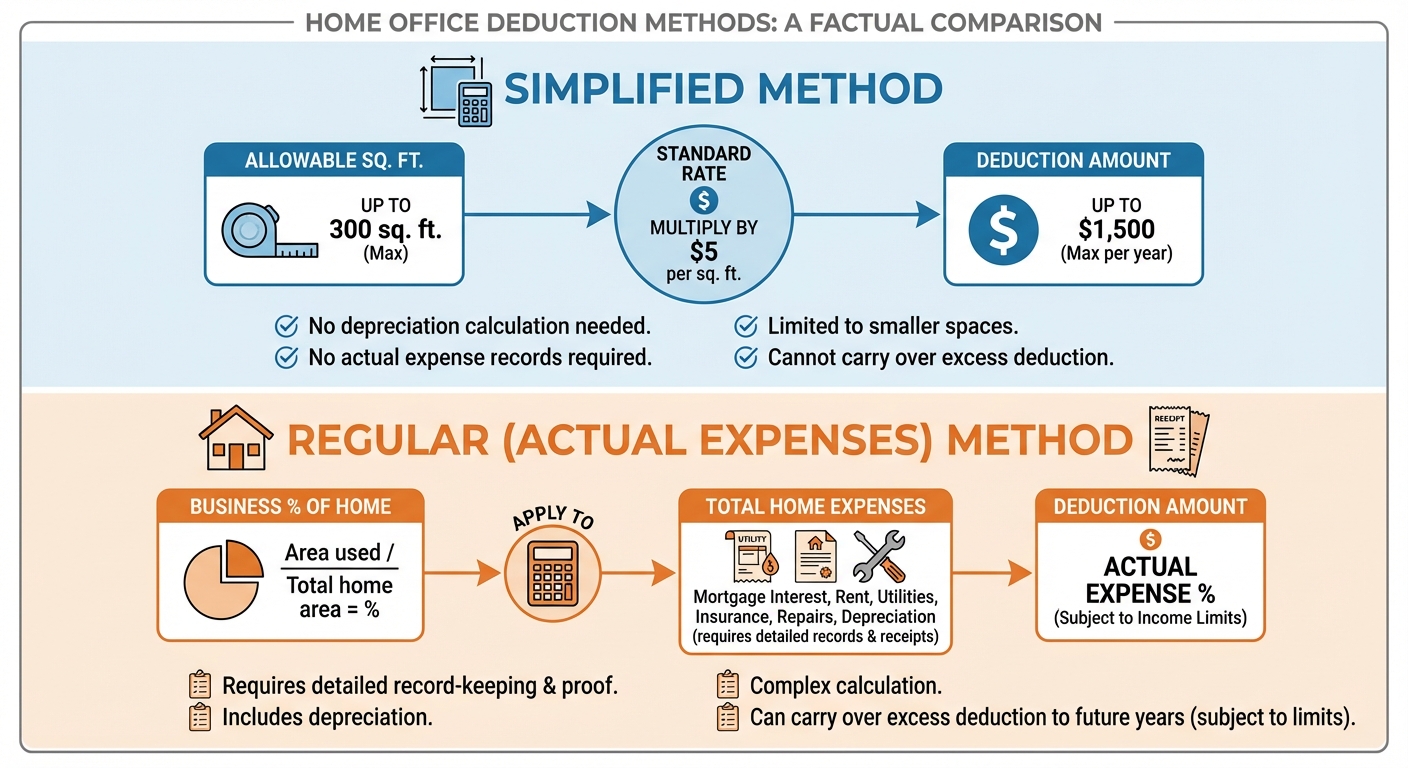

If you qualify, you have two methods for calculating your home office deduction: the simplified method and the regular method. The simplified method is easier but may result in a smaller deduction, while the regular method requires more recordkeeping but can yield larger savings.

The simplified method allows you to deduct $5 per square foot of your home office, up to a maximum of 300 square feet. That caps your deduction at $1,500 per year. You don’t need to track individual expenses or keep receipts for utilities, insurance, or repairs. The calculation takes about 30 seconds, and the IRS is less likely to scrutinize it.

The regular method calculates the actual expenses of maintaining your home office. You determine what percentage of your home is used for business by dividing your office square footage by your home’s total square footage. If your office is 200 square feet and your home is 2,000 square feet, your business-use percentage is 10%. You then apply that percentage to your actual home expenses: mortgage interest or rent, utilities, insurance, repairs, and depreciation. This method requires detailed records but often produces a larger deduction, especially for people with higher housing costs.

For renters, the regular method can be particularly valuable. You can deduct your business-use percentage of rent, which for high-rent cities can translate to significant savings. A freelancer paying $3,000 per month in rent with 15% business use could deduct $5,400 annually, far more than the simplified method’s $1,500 cap.

Common Misconceptions About the Deduction

Many people believe that having a dedicated home office automatically qualifies them for the deduction. This misunderstanding is widespread, especially among remote W-2 employees who’ve invested in desks, chairs, and equipment. The exclusive use of a space is necessary but not sufficient. Your employment status is the primary determining factor.

Another misconception is that the home office deduction triggers audits. While the IRS does scrutinize this deduction more than some others, claiming it doesn’t automatically flag your return. What matters is whether you legitimately qualify and have documentation to support your claim. If you genuinely use a dedicated space exclusively for self-employment work, you shouldn’t avoid a deduction you’re entitled to out of audit fear.

Some taxpayers also confuse the home office deduction with deducting home office equipment. If you’re self-employed, you can separately deduct business equipment like computers, printers, and office furniture under Section 179 or through depreciation, regardless of whether you claim the home office deduction itself. These are distinct deductions that work together but aren’t the same thing.

What You Can and Can’t Deduct

Under the regular method, allowable expenses fall into two categories: direct expenses and indirect expenses. Direct expenses benefit only your home office, like painting your office walls or installing a dedicated business phone line. You can deduct 100% of direct expenses. Indirect expenses benefit your entire home, like utilities, homeowners insurance, and general repairs. You deduct these based on your business-use percentage.

Expenses you can deduct include mortgage interest (or rent for renters), real estate taxes, utilities like electricity and internet, homeowners or renters insurance, repairs and maintenance, and depreciation of your home if you own it. For renters, the rent deduction alone often makes the regular method worthwhile.

Expenses you cannot deduct include lawn care and landscaping unless clients regularly visit your home, cleaning services for non-office areas, furniture and decor for personal spaces, and the base cost of your telephone if you use a single line for both personal and business calls. You can, however, deduct the business percentage of a combined internet and phone bill if you can document business use.

One important limitation: the home office deduction cannot create a business loss. If your business income is $8,000 and your calculated home office deduction would be $10,000, you can only deduct $8,000. However, the excess can be carried forward to future tax years when you have sufficient income to absorb it.

How to Claim the Deduction

To claim the home office deduction, you’ll need to file Schedule C (Profit or Loss from Business) if you’re a sole proprietor or single-member LLC. The home office deduction is calculated on Form 8829 if you’re using the regular method, or simply entered on Schedule C if you’re using the simplified method.

Gather your documentation before tax time. For the simplified method, you need only the square footage of your home office. For the regular method, you need records of all housing expenses, your home’s total square footage, and evidence that the space is used exclusively for business. Keeping a simple floor plan diagram that shows your office boundaries can be helpful if you’re ever questioned.

If you use tax software, both methods are well-supported with guided interviews that walk you through the calculation. If you work with a tax professional, bring your housing expense records and be prepared to discuss how you use your home office space.

Summary

You can deduct a home office on your federal taxes, but only if you’re self-employed. W-2 employees cannot claim this deduction, even if they work from home full-time. If you do qualify, choose between the simplified method ($5 per square foot, up to $1,500) and the regular method (actual expenses multiplied by business-use percentage), depending on which provides the larger benefit.

Keep records of your office dimensions and housing expenses. Ensure your space is used exclusively and regularly for business. When in doubt, consult a tax professional, especially if you’re unsure about your employment classification or have a complex living situation like a home-based business with employees or inventory.