A 401k match is when your employer contributes money to your retirement account based on how much you contribute. If your company offers a 50% match up to 6% of your salary, that means for every dollar you put in (up to 6% of your pay), your employer adds 50 cents. This is essentially free money added to your retirement savings, and not taking full advantage of it is one of the most common financial mistakes people make.

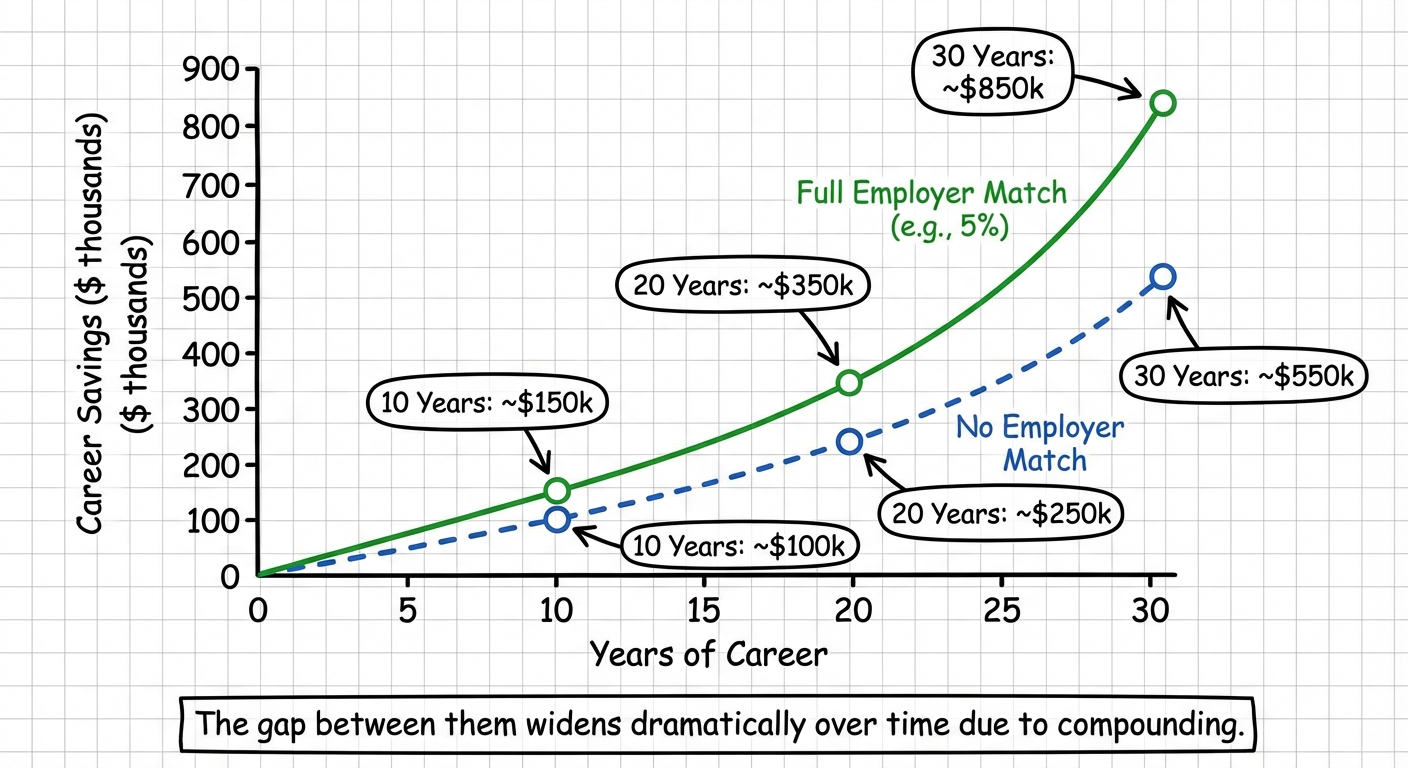

Here’s the simple math: If you earn $60,000 per year and contribute 6% ($3,600), your employer adds another $1,800 with a 50% match. That’s $1,800 you get just for participating. If you only contribute 3%, you’re leaving $900 on the table every single year. Over a 30-year career with investment growth, that lost match could cost you over $100,000 in retirement savings.

Understanding exactly how your match works is crucial because the formulas vary significantly between employers, and the details matter more than most people realize.

How Different Match Formulas Work

Employers structure their matches in several common ways, and the differences can be confusing. The two most important numbers are the match percentage (how much they contribute per dollar you put in) and the cap (the maximum salary percentage they’ll match on).

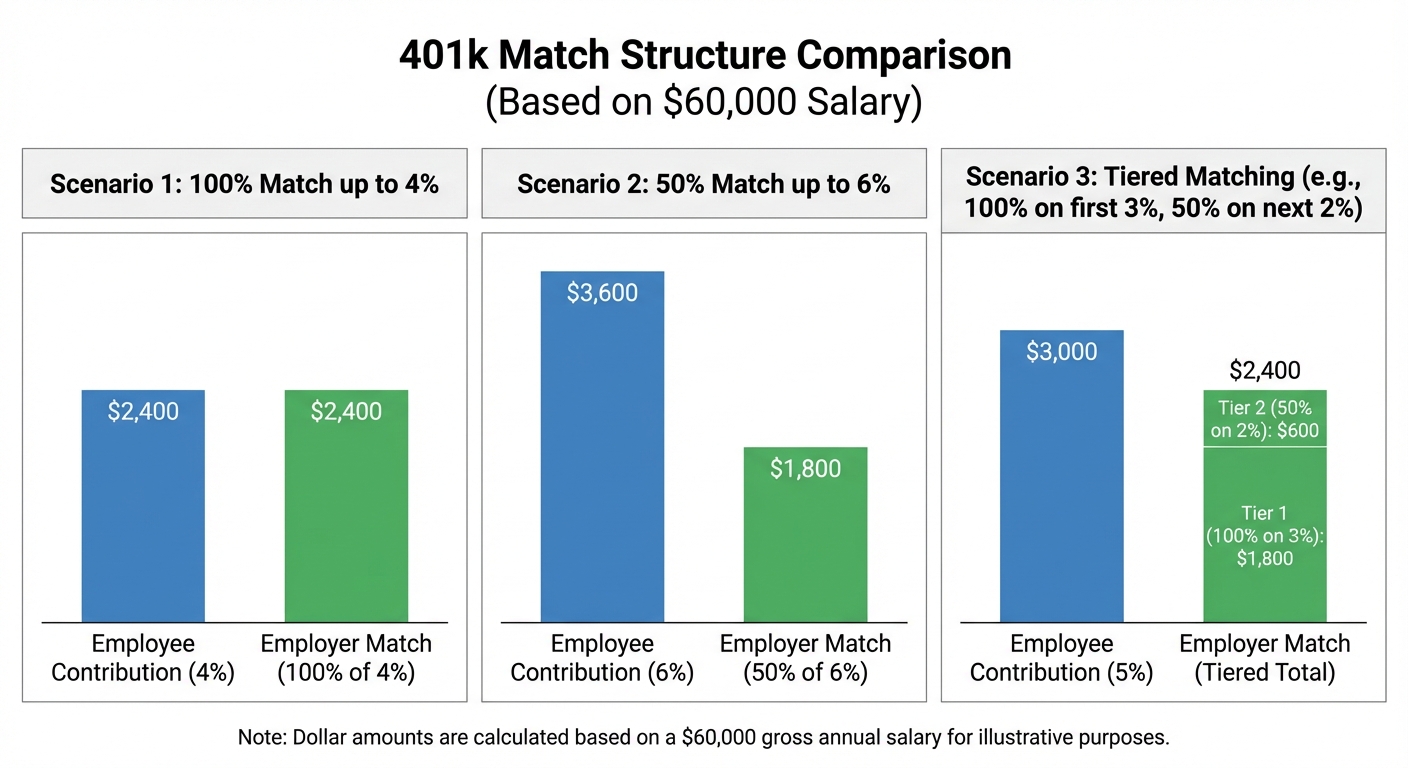

Dollar-for-dollar match up to a percentage is the most generous structure. If your employer offers a 100% match up to 4% of salary, they contribute $1 for every $1 you contribute, stopping when you hit 4% of your salary. On a $60,000 salary, contributing 4% ($2,400) gets you another $2,400 from your employer. Contributing more than 4% still benefits you, but your employer stops adding to it.

Partial match formulas are more common. A 50% match up to 6% means your employer contributes 50 cents for every dollar you put in, up to 6% of your salary. To get the full employer contribution here, you need to contribute 6%, which earns you an additional 3% from your employer. Some companies use tiered systems where they match 100% on the first 3% and 50% on the next 2%, which requires careful calculation to optimize.

Vesting Schedules Affect When the Money Is Actually Yours

There’s an important catch that surprises many people: employer contributions often come with a vesting schedule. Vesting determines when you actually own the matched money. Your own contributions are always 100% yours immediately, but the employer match might not be.

A typical vesting schedule might give you 20% ownership after one year, 40% after two years, and so on until you’re fully vested after five or six years. If you leave the company before you’re fully vested, you forfeit the unvested portion of the employer match. This is entirely legal and extremely common.

Some employers offer immediate vesting, which means their contributions are yours from day one. Others use cliff vesting, where you get nothing until a certain point (often three years), then suddenly own 100%. Before assuming you can access that match, check your plan documents or ask HR about your vesting schedule. This matters enormously if you’re considering changing jobs.

Why You Should Always Contribute Enough to Get the Full Match

Financial advisors almost universally agree: not capturing your full employer match is leaving guaranteed money on the table. A 50% match is effectively a 50% instant return on your investment before any market gains. No other investment offers anything close to that guaranteed return.

If money is tight, prioritize contributing at least enough to get the full match before putting money anywhere else, including paying off low-interest debt. The math heavily favors the match. A 50% guaranteed return beats paying down a 7% car loan every time. Once you’re capturing the full match, you can redirect extra funds to other financial goals.

The one exception is if you’re facing a genuine financial emergency or have extremely high-interest debt (like credit cards at 20%+). In those cases, stabilize your situation first, then resume contributions as quickly as possible.

Common Questions About 401k Matches

Do employer matches count toward the annual 401k limit? No. For 2026, you can contribute up to $23,500 of your own money, and employer matches are added on top of that. There’s a separate combined limit of $70,000 for total contributions from all sources, but most people never hit that ceiling.

What if I can’t afford to contribute enough for the full match? Start with whatever you can manage and increase your contribution rate by 1% every time you get a raise. Many plans offer automatic escalation features that do this for you. Even a 1% contribution that gets matched is better than nothing.

Should I contribute to a traditional or Roth 401k? This depends on whether you expect to be in a higher or lower tax bracket in retirement. The employer match always goes into the traditional (pre-tax) portion regardless of which type you choose for your own contributions.

Key Takeaways

A 401k match is one of the best benefits an employer can offer, and failing to capture the full match is equivalent to turning down part of your salary. Check your plan documents to understand exactly how your match works, know your vesting schedule before making job decisions, and prioritize contributing at least enough to get every dollar your employer is willing to give you. The long-term impact on your retirement savings is difficult to overstate.