How do you maximize your tax refund in 2026? The answer involves a combination of claiming every deduction you qualify for, taking advantage of refundable tax credits, choosing the right filing status, and timing your income and expenses strategically. Most taxpayers leave money on the table by missing deductions they qualify for or by taking the standard deduction when itemizing would yield a larger benefit.

The difference between a mediocre refund and a substantial one often comes down to preparation and knowledge. Taxpayers who understand which deductions exist, which credits are refundable versus nonrefundable, and how filing status affects their bracket can legally reduce their tax burden by thousands of dollars. This isn’t about loopholes or aggressive tax strategies. It’s about claiming what you’re entitled to under current tax law.

Understand the Difference Between Deductions and Credits

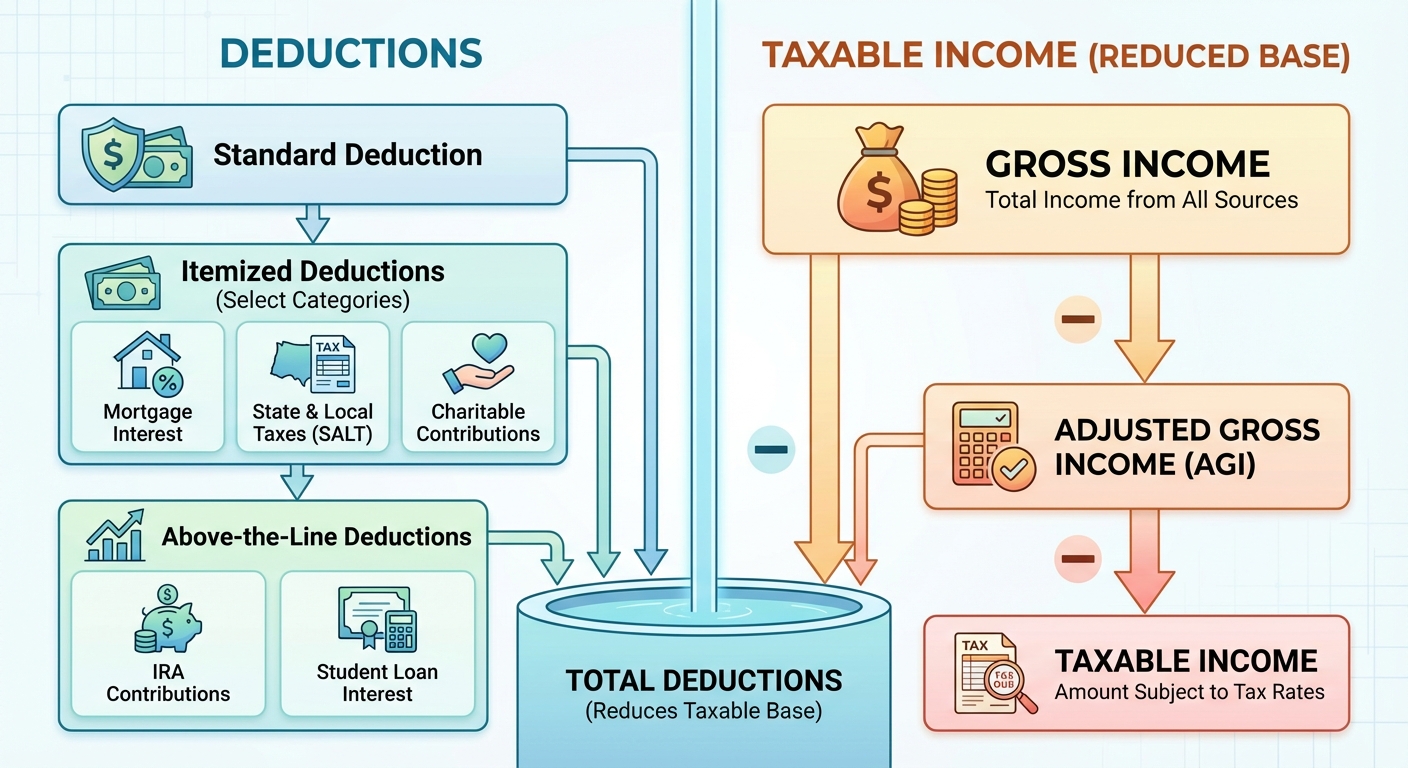

Before diving into specific strategies, you need to understand how deductions and credits work differently. Deductions reduce your taxable income, which indirectly reduces your tax bill. If you’re in the 22% tax bracket and claim a $1,000 deduction, you save $220 in taxes. Credits, on the other hand, reduce your tax bill dollar for dollar. A $1,000 tax credit saves you exactly $1,000.

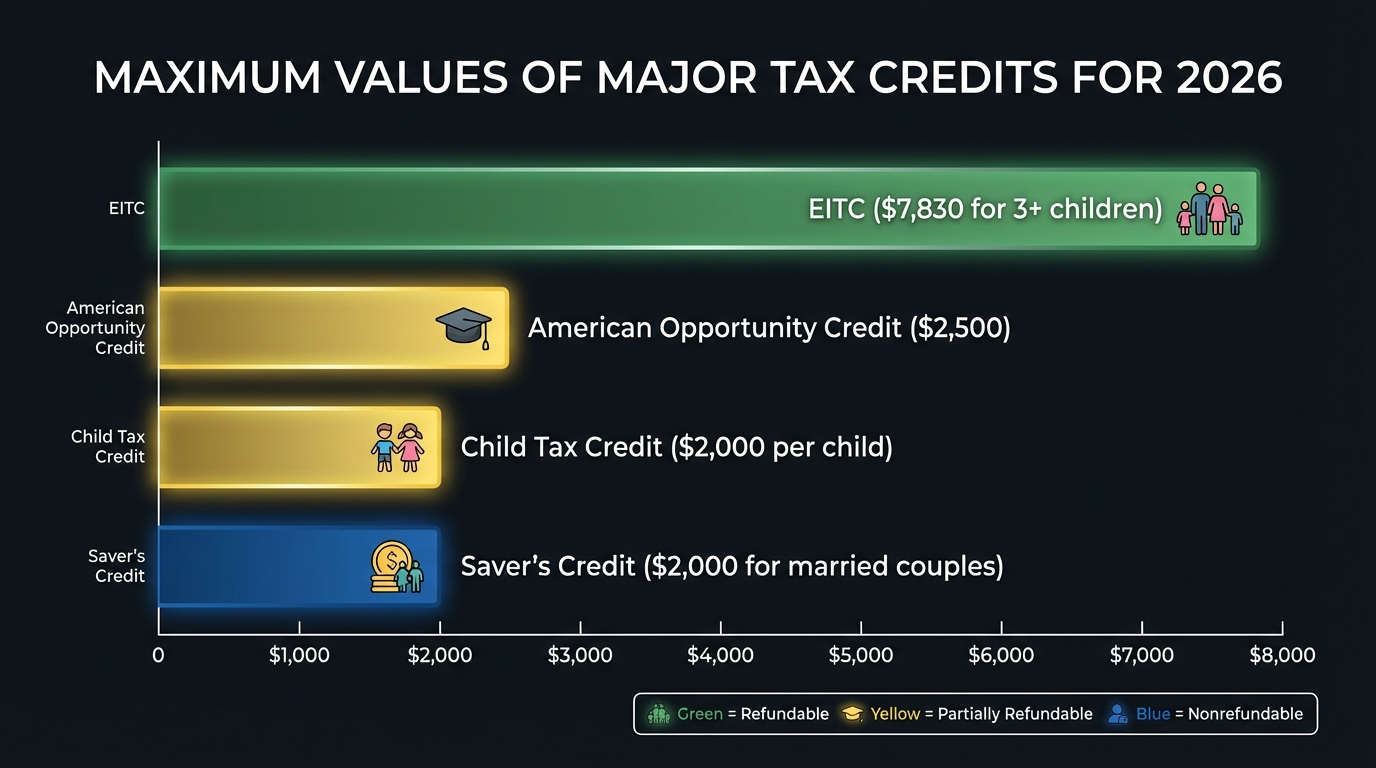

This distinction matters because credits are significantly more valuable than deductions of the same dollar amount. Prioritize finding credits you qualify for before optimizing deductions. Some credits are refundable, meaning you receive the full amount even if it exceeds your tax liability. Others are nonrefundable, meaning they can only reduce your tax bill to zero but won’t generate a refund on their own.

The most valuable refundable credits for 2026 include the Earned Income Tax Credit (EITC), the Child Tax Credit (partially refundable), the American Opportunity Credit (40% refundable up to $1,000), and the Premium Tax Credit for health insurance purchased through the marketplace. If you qualify for any of these, they should be the foundation of your refund maximization strategy.

Deductions That Make the Biggest Difference

The standard deduction for 2026 is $14,600 for single filers and $29,200 for married couples filing jointly. To benefit from itemizing, your total itemized deductions must exceed these thresholds. For many taxpayers, especially those in high-tax states or with significant medical expenses, itemizing yields a larger tax benefit.

State and local taxes (SALT) remain capped at $10,000, which limits the benefit for taxpayers in high-tax states. However, if you’re close to the itemizing threshold, this deduction combined with others might push you over. Property taxes, state income taxes, and local taxes all count toward this cap.

Mortgage interest is deductible on loans up to $750,000 for homes purchased after December 15, 2017. If you bought your home before that date, the limit is $1 million. For new homeowners especially, mortgage interest in the early years of a loan can be substantial enough to make itemizing worthwhile.

Medical expenses that exceed 7.5% of your adjusted gross income (AGI) are deductible. This threshold is high, but major medical events, ongoing treatments, or out-of-pocket costs for therapy, dental work, and prescription medications can add up. Keep records of every medical expense throughout the year, including mileage driven to medical appointments (22 cents per mile for 2026).

Charitable contributions are fully deductible if you itemize, up to 60% of your AGI for cash donations to public charities. If you don’t itemize, you lose this deduction entirely. For taxpayers who are close to the itemizing threshold, bunching charitable contributions, making two years’ worth of donations in one year, can push you into itemizing territory while taking the standard deduction in alternate years.

Tax Credits You Might Be Missing

The Earned Income Tax Credit is one of the most valuable and most overlooked credits. For tax year 2025, which you file in 2026, the maximum EITC ranges from $632 for taxpayers with no qualifying children to $7,830 for those with three or more qualifying children. Income limits vary by filing status and number of children, but many moderate-income households qualify without realizing it. The IRS estimates that 20% of eligible taxpayers don’t claim the EITC.

The Child Tax Credit provides up to $2,000 per qualifying child under age 17. Up to $1,700 of this is refundable as the Additional Child Tax Credit, meaning you can receive it even if you don’t owe taxes. Children must have a Social Security number and meet residency and relationship tests. This credit phases out at higher incomes but remains available to many middle-class families.

The Saver’s Credit rewards low and moderate-income taxpayers for contributing to retirement accounts. If your AGI is below certain thresholds, you can receive a credit of 10%, 20%, or 50% of your retirement contributions, up to a maximum credit of $1,000 for individuals or $2,000 for married couples. This credit is nonrefundable but can significantly reduce your tax bill.

Education credits deserve special attention for families with students. The American Opportunity Credit provides up to $2,500 per eligible student for the first four years of higher education, with 40% refundable. The Lifetime Learning Credit offers up to $2,000 per tax return for any post-secondary education, including graduate school and professional courses, though it’s nonrefundable. You can only claim one education credit per student per year, so calculate which yields the larger benefit.

The Premium Tax Credit helps offset health insurance costs for taxpayers who purchase coverage through the Health Insurance Marketplace. If you underestimated your income when applying for coverage, you may have received too little in advance credits and are owed a larger refund. Conversely, if your income exceeded estimates, you may owe money back, so reconcile your Form 1095-A carefully.

Filing Status Strategies

Your filing status significantly affects your tax bracket thresholds, standard deduction amount, and eligibility for certain credits. Choosing the optimal status is one of the easiest ways to reduce your tax liability.

Married couples can choose between filing jointly or separately. In most cases, filing jointly results in a lower combined tax bill because of more favorable bracket thresholds and access to credits that married-filing-separately taxpayers can’t claim. However, there are situations where filing separately makes sense: if one spouse has significant medical expenses (easier to exceed the 7.5% AGI threshold with lower individual income), if one spouse has income-based student loan payments, or if there are concerns about one spouse’s tax liability.

Head of household status is available to unmarried taxpayers who pay more than half the cost of maintaining a home for a qualifying person, typically a dependent child. This status provides a larger standard deduction ($21,900 in 2026) and more favorable bracket thresholds than single filing. Many single parents who qualify for head of household file as single by mistake, missing out on significant tax savings.

If your spouse passed away in 2024 or 2025 and you have a dependent child, you may qualify for qualifying surviving spouse status, which allows you to use married filing jointly brackets and standard deduction for up to two years after your spouse’s death.

Timing Strategies for Income and Expenses

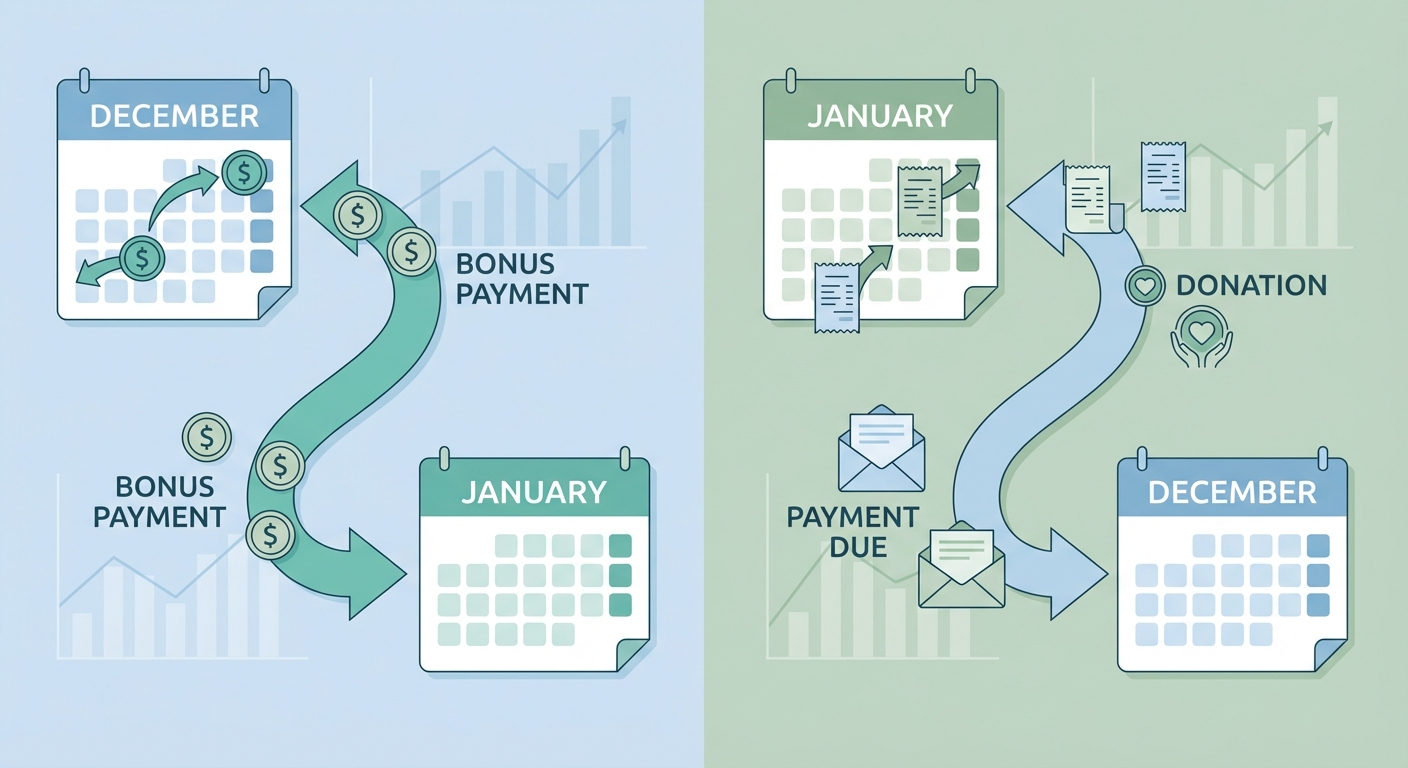

If you have control over when you receive income or incur deductible expenses, strategic timing can shift tax liability between years. This is most relevant for self-employed individuals, freelancers, and those with variable income, but traditional employees also have some opportunities.

Deferring income into the following tax year keeps it out of your current year’s taxable income. If you’re expecting a bonus in late December, ask your employer if it can be paid in January. Self-employed individuals can delay invoicing clients until January for work completed in December. This strategy works best when you expect to be in a lower tax bracket next year.

Accelerating deductions into the current year provides immediate tax savings. If you’re itemizing and close to the threshold, prepaying your January mortgage payment in December, paying your full property tax bill before year-end, or making charitable contributions before December 31 can boost your itemized deductions. Bunch multiple years of charitable giving into a single year to exceed the standard deduction threshold.

Retirement contributions represent one of the most effective timing strategies. You have until the tax filing deadline, typically April 15, to make IRA contributions for the previous tax year. If you’re filing your 2025 taxes in March 2026 and have room for additional retirement savings, you can still contribute to a traditional IRA and deduct it from your 2025 income. For 2025, the IRA contribution limit is $7,000, or $8,000 if you’re 50 or older.

Health Savings Account (HSA) contributions follow the same rule. If you had HSA-eligible health coverage in 2025, you can contribute up to $4,300 for individual coverage or $8,550 for family coverage (plus $1,000 catch-up if 55 or older) until April 15, 2026, and deduct it from your 2025 taxes. HSA contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses, making them one of the most tax-advantaged savings vehicles available.

Above-the-Line Deductions Everyone Should Know

Above-the-line deductions, also called adjustments to income, reduce your AGI directly and can be claimed regardless of whether you itemize. Lower AGI not only reduces taxes directly but can also help you qualify for credits and deductions that phase out at higher income levels.

Student loan interest is deductible up to $2,500 per year, even if you don’t itemize. The deduction phases out at higher incomes but remains available to many borrowers. If you’re repaying federal or private student loans, this deduction provides meaningful relief.

Educator expenses allow teachers and other eligible educators to deduct up to $300 for classroom supplies, professional development, and materials purchased out of pocket. If both spouses are educators, each can claim the deduction.

Self-employment taxes are partially deductible. If you’re self-employed, you pay both the employer and employee portions of Social Security and Medicare taxes. You can deduct the employer-equivalent portion (half of your self-employment tax) as an above-the-line deduction.

Health insurance premiums for self-employed individuals are deductible above the line, including premiums for your spouse and dependents. This is one of the most valuable deductions for freelancers and small business owners, as health insurance premiums can easily reach thousands of dollars annually.

Documentation and Record-Keeping

Maximizing your refund requires documentation. The IRS won’t disallow a legitimate deduction simply because you claimed it, but if you’re audited, you need proof. Good record-keeping throughout the year makes tax time easier and ensures you don’t miss deductions due to lost receipts.

Keep receipts for all potential deductions, organized by category. Digital tools like expense tracking apps can photograph and categorize receipts automatically. At minimum, save documentation for medical expenses, charitable donations, business expenses if self-employed, and any other expenses you plan to deduct.

For charitable contributions over $250, you need written acknowledgment from the organization. For non-cash donations like clothing and household items, document the fair market value and condition of items donated. If you donate a vehicle or other high-value item, additional documentation requirements apply.

If you’re claiming the home office deduction, maintain a floor plan showing your dedicated workspace and records of your home expenses. For the vehicle deduction, keep a mileage log documenting business trips, including date, destination, business purpose, and miles driven.

Summary

Maximizing your 2026 tax refund starts with understanding the difference between deductions and credits, then systematically claiming everything you qualify for. Focus first on refundable credits like the EITC and Child Tax Credit, which can generate refunds even if you don’t owe taxes. Compare the standard deduction to your itemized deductions to determine which saves more.

Use above-the-line deductions to lower your AGI regardless of whether you itemize. Time income and expenses strategically if you have flexibility. Contribute to traditional IRAs and HSAs before the filing deadline to reduce last year’s taxable income. Most importantly, keep organized records throughout the year so you don’t miss deductions for lack of documentation.

If your tax situation is complex, involving self-employment income, rental properties, investments, or significant life changes, consider working with a tax professional. The cost of professional preparation often pays for itself through deductions and credits a software program might miss.