Your credit score isn’t stuck where it is. If you’re looking to improve your credit score quickly, the good news is that certain actions can show results in as little as 30 to 45 days. The key is knowing which strategies actually move the needle versus which ones are just marketing noise.

The most effective quick wins involve paying down credit card balances, disputing errors on your credit report, and strategically timing your payments. According to Experian, reducing your credit utilization below 30% and disputing inaccuracies are the fastest paths to score improvement. However, some changes, like building a longer credit history, simply take time and have no shortcuts.

What Actually Affects Your Credit Score

Before diving into improvement strategies, it helps to understand what the credit bureaus actually measure. Your FICO score, which is used by 90% of lenders, breaks down into five components with different weights.

Payment history carries the most weight at 35% of your score. This measures whether you pay your bills on time, how late any missed payments were, and how recently any delinquencies occurred. A single 30-day late payment can drop your score by 50 to 100 points, and that negative mark stays on your report for seven years.

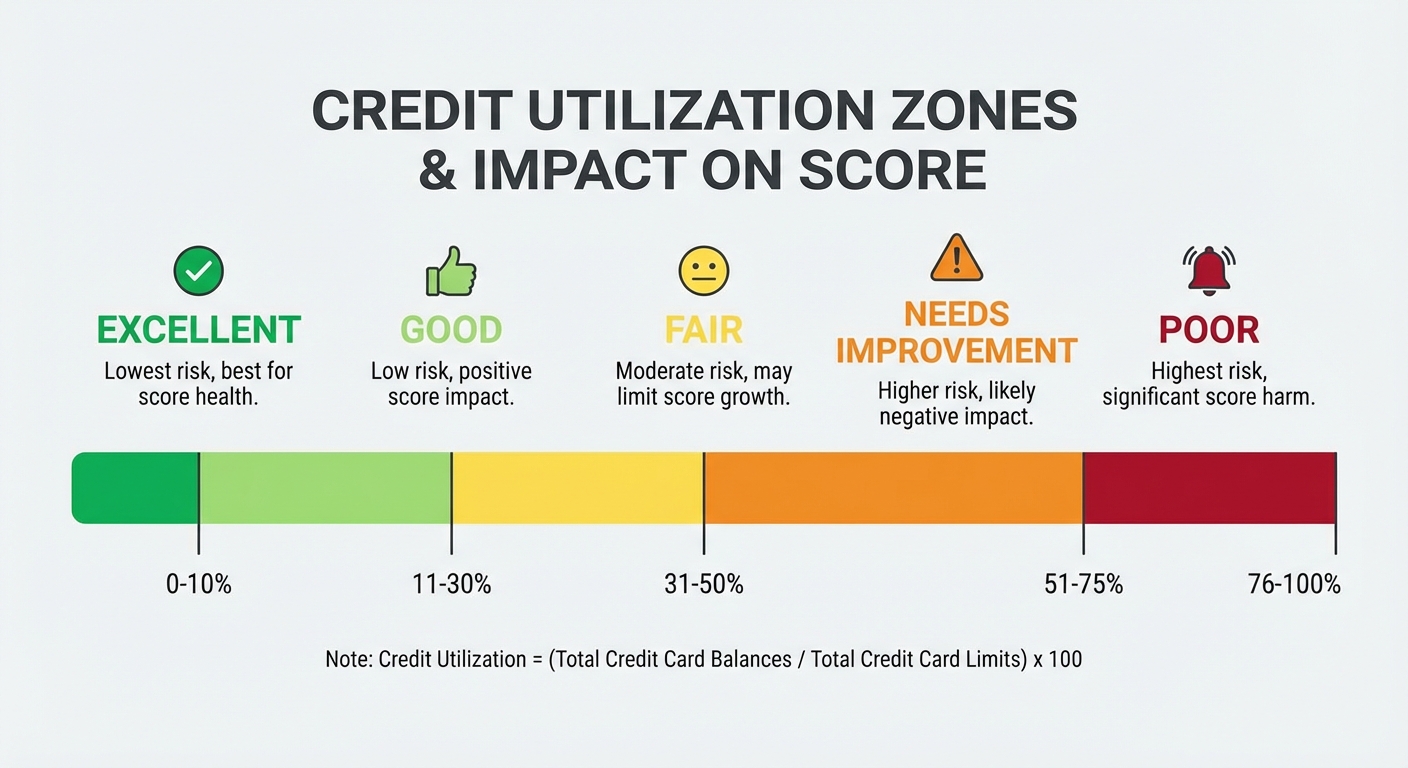

Credit utilization accounts for 30% of your score and measures how much of your available credit you’re actually using. This is calculated both per card and across all your accounts. The lower your utilization, the better, with most experts recommending you stay below 30% and ideally under 10% for optimal scores.

The remaining 35% is split between length of credit history (15%), credit mix (10%), and new credit inquiries (10%). These factors are harder to change quickly, which is why the fastest improvements come from the first two categories.

The Fastest Way to Boost Your Score: Lower Your Utilization

Credit utilization updates on your report every month when your credit card issuers report your balances. This means changes show up relatively quickly compared to other factors.

The strategy is straightforward: pay down your credit card balances before your statement closing date, not just before the due date. Many people don’t realize that banks report your balance on the statement date, so even if you pay in full by the due date, a high balance might still appear on your credit report.

For maximum impact, aim to get your utilization under 10% on each card. If you carry a $3,000 balance on a card with a $10,000 limit, paying it down to under $1,000 could boost your score noticeably within the next reporting cycle. According to Credit.com, keeping utilization between 1% and 10% is the sweet spot for those aiming for scores above 700.

If you can’t pay down balances immediately, another option is requesting a credit limit increase. This lowers your utilization percentage without requiring you to pay anything down. However, be aware that some issuers perform a hard inquiry for limit increases, which could temporarily ding your score by a few points.

Dispute Errors on Your Credit Report

According to a Federal Trade Commission study, one in five consumers has an error on at least one of their credit reports. Four out of five people who dispute errors see their reports updated as a result.

Start by pulling your free credit reports from all three bureaus at AnnualCreditReport.com. Look for accounts you don’t recognize, incorrect late payment records, wrong credit limits or balances, and accounts that should have aged off (most negative items should disappear after seven years).

When you find an error, file a dispute directly with the credit bureau reporting the inaccurate information. You can do this online, but sending a written dispute via certified mail creates a paper trail. The bureau has 30 days to investigate and respond. If the information can’t be verified, it must be removed or corrected.

Even small errors matter. An incorrect credit limit being reported as lower than your actual limit artificially inflates your utilization ratio. Getting this corrected can provide an immediate score boost.

Strategies That Work Over the Medium Term

Some legitimate credit-building strategies take a few months to show full results. Becoming an authorized user on someone else’s well-managed credit card account can help if you have a thin credit file. The account’s positive history gets added to your report, potentially boosting your score. Just make sure the primary cardholder has a good payment history and low utilization.

Keeping old accounts open, even if you rarely use them, helps your score in two ways. First, it maintains your available credit, which keeps utilization low. Second, it preserves the length of your credit history. Closing your oldest card can actually hurt your score by shortening your average account age.

If you’re building credit from scratch or rebuilding after significant damage, a secured credit card can help establish positive payment history. These cards require a deposit that typically becomes your credit limit. After six to twelve months of on-time payments, you may qualify for an unsecured card.

What Doesn’t Work (Despite What You’ve Heard)

Certain credit improvement tactics are either myths or actually counterproductive. Carrying a balance does not help your credit score. This persistent myth has caused people to pay unnecessary interest. You get the same credit-building benefit from paying your statement in full each month.

Closing unused cards to “simplify” your finances often backfires. You lose that available credit, which increases your utilization ratio, and you potentially shorten your credit history. Unless a card has an annual fee you can’t justify, keeping it open and using it occasionally is usually the better choice.

Credit repair companies that promise to remove accurate negative information are also a red flag. Legitimate negative items, like actual late payments, cannot be legally removed before they age off. These companies often charge hundreds or thousands of dollars for services you can do yourself for free. If you need help, consider a nonprofit credit counseling agency accredited by the National Foundation for Credit Counseling.

A Realistic Timeline for Improvement

Understanding how long improvement takes helps set realistic expectations. Within 30 to 45 days, you can see results from lowering credit utilization and getting errors removed from your report. These changes reflect in the next reporting cycle.

Over three to six months, you’ll see the benefits of consistent on-time payments building up. If you’ve recently had hard inquiries, their impact on your score diminishes during this period. New accounts also start building positive history.

Significant improvement, particularly if you’re recovering from major setbacks like bankruptcy or multiple late payments, typically takes one to two years of consistent positive behavior. The good news is that the impact of negative items diminishes over time, even before they completely age off your report.

Key Takeaways

Your credit score can improve faster than you might think, but not every strategy delivers quick results. Focus first on reducing your credit utilization below 10% and disputing any errors on your credit report. These two actions offer the fastest potential improvement.

Avoid paying for credit repair services and ignore anyone claiming they can remove accurate negative information. Instead, build good habits: set up automatic payments to never miss a due date, keep old accounts open, and monitor your credit regularly. For more guidance on managing your finances effectively, check out our guide on how to create a budget that sticks and learn about the difference between APR and interest rates.

The most important factor in your credit score is your payment history, and there’s no shortcut for that. Pay your bills on time, every time, and your score will reflect your reliability over time.