What is an HSA and is it worth it? A Health Savings Account is a tax-advantaged savings account that lets you set aside pre-tax money specifically for medical expenses. For people who qualify, it’s almost always worth it because HSAs offer a unique “triple tax advantage” that no other account type provides: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

The catch is that you need a High-Deductible Health Plan (HDHP) to be eligible. If your employer offers an HDHP option or you purchase one through the marketplace, opening an HSA could be one of the smartest financial moves available to you. For 2026, you can contribute up to $4,400 if you have self-only coverage or $8,750 for family coverage, plus an additional $1,000 if you’re 55 or older.

How an HSA Actually Works

An HSA functions as a personal savings account with special tax treatment from the IRS. You open the account through a bank, credit union, or financial services company that offers HSA accounts. Many employers set up HSAs automatically when employees enroll in the company’s HDHP, though you can also open one independently if you have qualifying insurance.

Money goes into the account through payroll deductions (if your employer facilitates it) or through direct contributions you make yourself. When you contribute through payroll, the money comes out before federal income tax, Social Security tax, and Medicare tax are calculated. This means you get an immediate tax break on every dollar you contribute. If you contribute directly, you deduct the contributions when you file your taxes, though you won’t get the payroll tax savings.

The funds in your HSA belong to you permanently. Unlike a Flexible Spending Account (FSA), which typically requires you to “use it or lose it” each year, HSA balances roll over indefinitely. If you leave your job, the money stays yours. If you switch health plans and no longer have an HDHP, you keep the account and can still use the funds for medical expenses. You just can’t make new contributions until you have qualifying insurance again.

The Triple Tax Advantage Explained

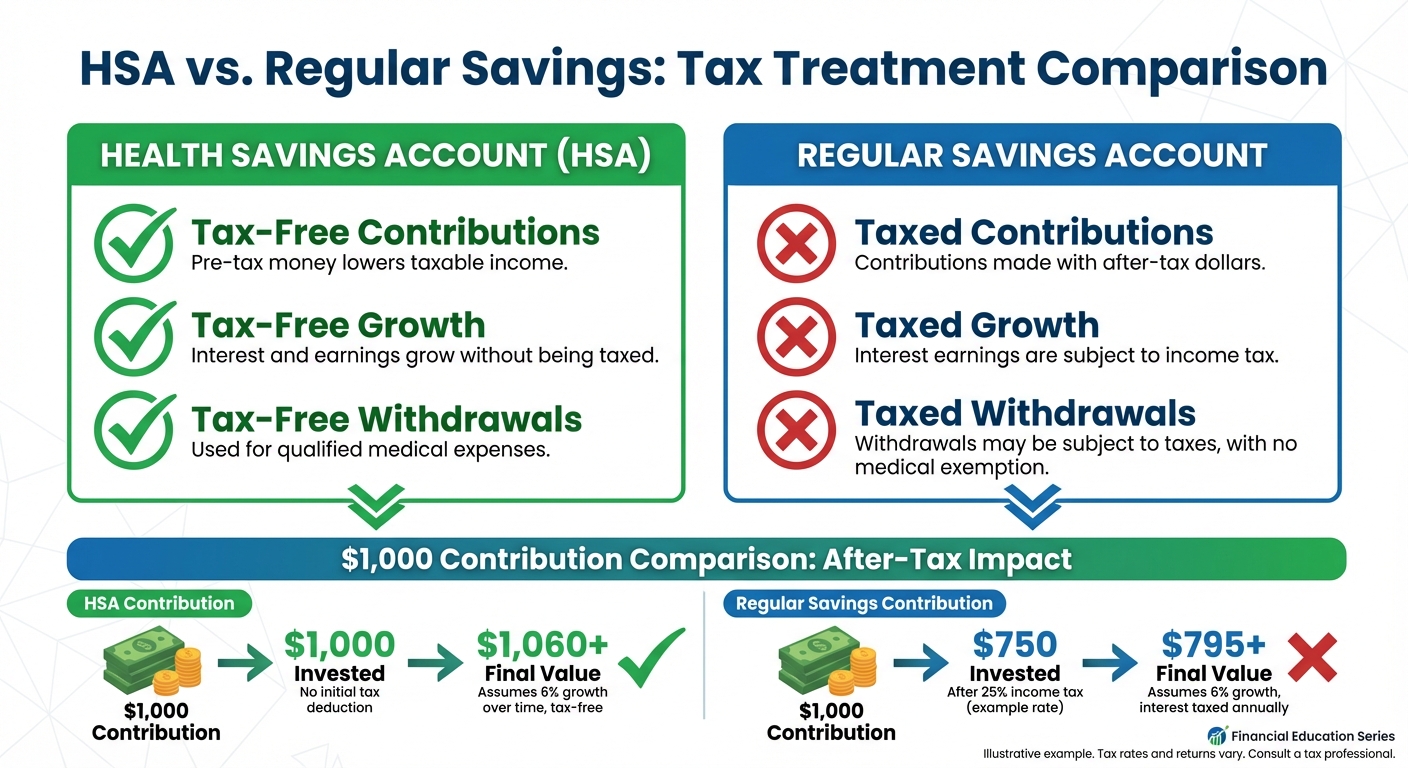

The reason financial advisors get excited about HSAs comes down to three distinct tax benefits working together. No other account in the U.S. tax code offers all three.

Tax benefit one: contributions reduce your taxable income. If you earn $60,000 and contribute $4,400 to your HSA, you’re only taxed on $55,600. Depending on your tax bracket, that could save you $700 to $1,500 or more in federal taxes alone. If contributions come through payroll deduction, you also avoid the 7.65% in Social Security and Medicare taxes, adding another $337 in savings on a full contribution.

Tax benefit two: your money grows tax-free. Most HSA providers allow you to invest your balance in mutual funds once you reach a certain threshold, typically $1,000 to $2,000. Any interest, dividends, or capital gains earned in the account aren’t taxed. Over decades, this tax-free growth can compound significantly. Someone who maxes out their HSA for 20 years and invests the balance could accumulate well over $200,000, depending on market returns.

Tax benefit three: withdrawals for qualified medical expenses are tax-free. When you use HSA funds for eligible expenses like doctor visits, prescriptions, dental care, vision care, or even some over-the-counter medications, you pay no tax on the withdrawal. The IRS publishes a comprehensive list of qualified expenses in Publication 502, which includes items many people don’t expect, like sunscreen, bandages, and certain home modifications for medical conditions.

Who Should Open an HSA

HSAs make the most sense for people who can afford to pay routine medical expenses out of pocket while letting their HSA balance grow. If you’re relatively healthy and don’t anticipate major medical expenses, you can treat the HSA as a long-term investment account and build significant wealth over time.

The math also works in favor of anyone who expects future medical expenses. Healthcare costs in retirement are substantial, with Fidelity estimating that a 65-year-old couple retiring in 2026 will need approximately $315,000 saved just for healthcare expenses. An HSA lets you save specifically for these costs in the most tax-efficient way possible.

People who should think carefully before choosing an HDHP (and therefore an HSA) include those with chronic conditions requiring frequent care, families expecting significant medical expenses, and anyone who would struggle to cover the higher deductible in an emergency. The HDHP’s lower premiums and HSA tax benefits don’t help much if the high deductible creates financial stress when you actually need care.

HSA vs. FSA: Understanding the Difference

People often confuse HSAs with Flexible Spending Accounts because both let you use pre-tax dollars for medical expenses. The differences matter significantly for long-term planning.

FSAs are employer-owned accounts with a “use it or lose it” rule. Your employer may allow you to roll over up to $640 into the next year or give you a 2.5-month grace period, but generally, unspent FSA funds disappear. FSAs don’t require a high-deductible health plan, so they’re available to more people. The 2026 FSA contribution limit is $3,300.

HSAs, by contrast, have no expiration. Every dollar you contribute stays yours forever. You can invest the balance and let it grow for decades. You can even use HSA funds in retirement for non-medical expenses without penalty (though you’ll pay income tax, similar to a traditional IRA). If you have access to both account types, maxing out your HSA first usually makes more strategic sense.

What You Can Use HSA Funds For

The IRS defines “qualified medical expenses” broadly enough that most healthcare spending qualifies. Common eligible expenses include doctor and specialist visits, hospital stays and surgeries, prescription medications, dental cleanings, fillings, and orthodontics, vision exams, glasses, and contact lenses, mental health services and therapy, and medical equipment like crutches or blood pressure monitors. You can also use HSA funds for your spouse and dependents, even if they aren’t covered by your HDHP.

Expenses that don’t qualify include cosmetic procedures, gym memberships (in most cases), and health insurance premiums (with some exceptions for COBRA, long-term care insurance, and premiums while receiving unemployment benefits). Using HSA funds for non-qualified expenses before age 65 triggers income tax plus a 20% penalty. After 65, non-qualified withdrawals are taxed as income but don’t incur the penalty.

Smart HSA users often pay current medical expenses out of pocket and let their HSA balance grow, keeping receipts for potential reimbursement years later. Since there’s no time limit on reimbursement, you could pay for braces in 2026 out of pocket, then reimburse yourself from your HSA in 2046 after two decades of tax-free growth.

Key Takeaways

An HSA offers unmatched tax advantages for anyone eligible: tax-free contributions, growth, and withdrawals for medical expenses. For 2026, contribution limits are $4,400 for self-only coverage and $8,750 for family coverage. The account requires a High-Deductible Health Plan, which means accepting higher out-of-pocket costs in exchange for lower premiums and HSA eligibility.

For most people with access to an HDHP, opening and contributing to an HSA is worth it. The account functions as both a healthcare fund and a powerful long-term savings vehicle. If you’re already managing your budget effectively and understand how to maximize tax advantages, an HSA should be near the top of your financial priority list. Even small contributions compound meaningfully over time, and the triple tax benefit ensures more of your money works for you rather than going to taxes.