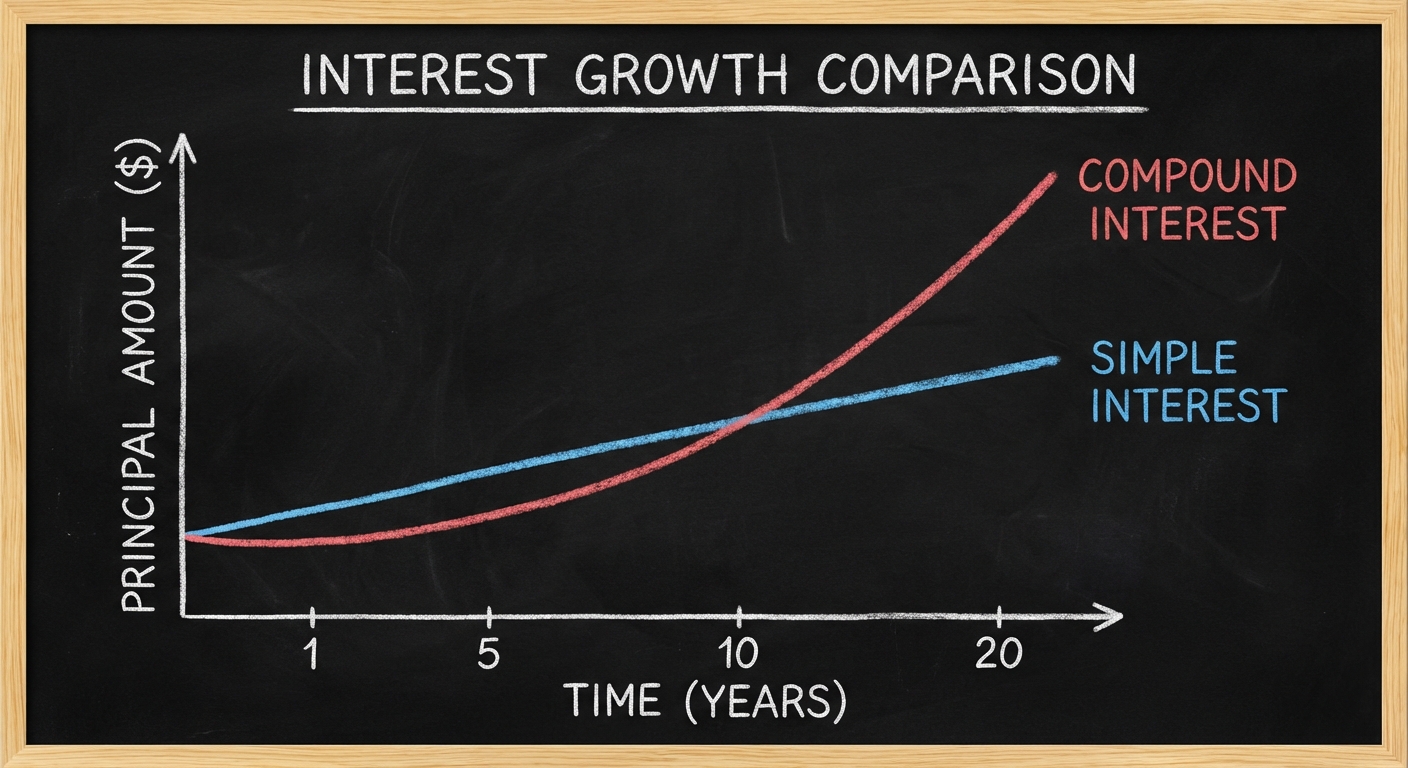

Compound interest is when you earn interest not just on your original money, but also on the interest you’ve already earned. It’s often called the “eighth wonder of the world” because of how dramatically it can grow wealth over time. But the same principle works against you when you carry debt, making credit cards and loans more expensive than they initially appear.

Here’s the key concept: with simple interest, $10,000 at 5% earns $500 per year, forever. With compound interest, that $500 gets added to your principal, so the next year you earn 5% on $10,500, giving you $525. The extra $25 doesn’t sound like much, but over decades, this snowball effect becomes enormous.

How Compound Interest Actually Works

The mechanics of compound interest involve a feedback loop where earnings generate their own earnings. When your investment pays interest, that interest is added to your balance. The next time interest is calculated, it’s computed on the new, larger balance. This cycle repeats indefinitely.

Consider a simple example with round numbers. You invest $10,000 at 7% annual interest, compounded yearly. After year one, you have $10,700. After year two, you don’t just add another $700. Instead, you earn 7% on $10,700, which is $749, bringing your total to $11,449. After year three, you earn 7% on $11,449, which is $801.

By year ten, your balance has grown to $19,672, nearly doubling without adding any new money. By year twenty, it’s $38,697. By year thirty, it’s $76,123. Notice how most of the growth happens in the later years. That’s the compounding effect accelerating over time.

The frequency of compounding also matters. Interest that compounds monthly grows faster than interest that compounds yearly because you start earning interest on your interest more frequently. A 7% annual rate compounded monthly is equivalent to about 7.23% compounded annually. Most savings accounts and investments compound daily or monthly.

The Rule of 72: A Quick Estimate

There’s a handy shortcut for understanding how fast your money can double at various interest rates. Divide 72 by your interest rate, and you get the approximate number of years to double your investment.

At 6% interest, your money doubles in about 12 years (72 divided by 6). At 8%, it takes about 9 years. At 12%, only 6 years. This rule isn’t perfect for extreme rates, but it’s remarkably accurate for typical investment returns and helps you quickly evaluate opportunities.

The rule works in reverse to show the impact of fees. If an investment earns 7% but charges 2% in fees, your effective return is 5%, doubling your money every 14.4 years instead of every 10.3 years. Over a 30-year career, that fee difference costs you almost half your potential wealth.

Time is the most important ingredient in compound interest. Starting early matters far more than investing larger amounts later. Someone who invests $5,000 per year from age 25 to 35, then stops, will often have more at 65 than someone who invests $5,000 per year from 35 to 65. The early investor put in $50,000 over 10 years; the late investor put in $150,000 over 30 years. But the early investor’s money had more time to compound.

Compound Interest Working Against You: Debt

The same math that builds wealth can also trap you in debt. Credit card interest typically compounds daily, and rates often exceed 20% APR. If you carry a balance, you pay interest on your interest, making debt grow faster than most people realize.

Take a $5,000 credit card balance at 22% APR. If you make only minimum payments, which might start around $100 per month, you’ll pay back about $13,000 over 9 years. The interest cost is $8,000, more than the original purchase. This is compound interest working in the card company’s favor, not yours.

Car loans and mortgages typically use amortizing structures that front-load interest payments. Early in a mortgage, most of your payment goes to interest, with only a small portion reducing the principal. It’s not until years into the loan that principal payments start dominating. This is why paying extra toward principal early in a loan saves so much in total interest.

Understanding APR versus interest rate helps you compare loans accurately. The APR accounts for fees and compounding, giving you a more realistic picture of what borrowing actually costs. When comparing credit cards or loans, always compare APRs rather than just stated interest rates.

Putting Compound Interest to Work

The practical application of compound interest involves starting as early as possible and being consistent. Even small amounts invested early can outperform large amounts invested later because of time’s multiplying effect.

If you have access to a 401(k) with employer matching, that’s essentially free money that immediately starts compounding. A 50% match on your contributions is an instant 50% return before any investment growth. Over 30 years of compounding, every dollar of match can grow to $10 or more.

High-yield savings accounts and certificates of deposit offer lower returns than stock market investments, but they provide guaranteed compound growth. In January 2026, many high-yield savings accounts offer around 4-5% APY. A $10,000 emergency fund earning 4.5% compounded daily grows to about $15,600 over ten years without adding anything.

For longer-term goals like retirement, stock market index funds have historically returned about 7% after inflation over long periods. This isn’t guaranteed for any specific timeframe, but for 20-plus year horizons, equities have consistently outperformed other asset classes. The key is staying invested through market fluctuations to capture that compound growth.

Common Mistakes to Avoid

One frequent error is underestimating how much high-interest debt costs you. Paying off a 22% credit card balance is equivalent to earning a guaranteed 22% return on your money, which is nearly impossible to achieve through any normal investment. Prioritize paying down high-interest debt before investing beyond any employer match.

Another mistake is cashing out retirement accounts when changing jobs. The withdrawal itself is taxed, and you permanently lose all the future compound growth that money would have generated. A $10,000 withdrawal at age 30 doesn’t just cost you $10,000. It costs you the $70,000 or more it could have grown to by retirement.

Waiting to invest until you “have more money” usually means waiting forever. The math strongly favors starting small and early over waiting to start big later. Even $50 or $100 per month, invested consistently in low-cost index funds, can grow to hundreds of thousands over a career. Creating a budget helps you find money to invest regularly.

Key Takeaways

Compound interest is the mathematical principle that makes money grow exponentially over time. It works by earning interest on your interest, creating a snowball effect that accelerates as your balance grows. The Rule of 72 gives you a quick estimate: divide 72 by your interest rate to find how many years until your money doubles.

Time is the crucial ingredient. Starting early beats starting big because your money has more years to compound. A dollar invested at 25 is worth far more than a dollar invested at 45, even though it’s the same dollar.

The same math that builds wealth also makes debt expensive. Credit card interest compounds against you daily, which is why carrying balances can spiral into much larger debts than you initially borrowed. Paying off high-interest debt is often your best possible investment return.

Start investing as early as you can, even if it’s a small amount. Avoid high-interest debt when possible, and pay it off quickly when you can’t. Understanding compound interest is one of the most valuable pieces of financial knowledge you can have.