How do you use AI to set financial goals? Start by giving the AI specific information about your situation: your income, current savings, debts, and what you want to achieve. Ask it to help you create realistic timelines, break down large goals into monthly targets, and identify potential obstacles. Tools like ChatGPT, Claude, and Google’s Gemini can help you think through financial decisions, though you should verify any specific numbers or claims before acting on them.

AI assistants excel at personalized calculations and scenario planning that would otherwise require a spreadsheet or financial advisor. They can take your messy financial situation and help organize it into clear action steps. But they’re not financial advisors, they can make mistakes, and they don’t know details about tax law or investment options that may have changed after their training data. Treat AI as a smart brainstorming partner, not an authoritative source.

What AI Can Actually Help With

AI tools are genuinely useful for several aspects of financial planning. Understanding where they add value helps you use them effectively without expecting more than they can deliver.

Breaking down big goals into smaller steps is something AI does well. If you tell it “I want to save $15,000 for a car down payment in 18 months,” it can calculate that you need roughly $833 per month, suggest where that money might come from based on your income and expenses, and help you identify which months might be harder to hit that target.

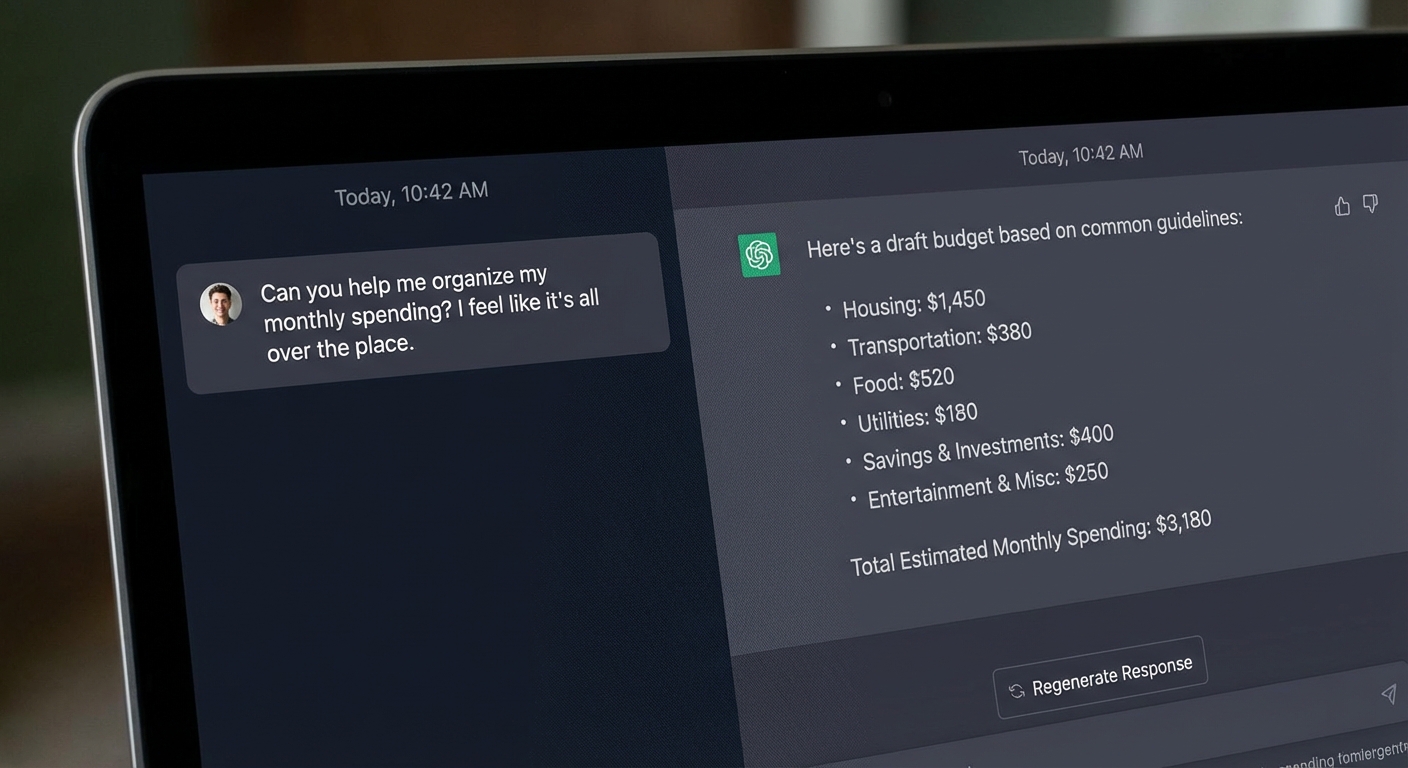

Creating budgets from messy data becomes easier with AI assistance. You can paste in a list of your expenses and income, even in a disorganized format, and ask the AI to categorize them and identify patterns. It can spot that you’re spending more on subscriptions than you realized or that your restaurant spending spikes on weekends. This analysis would take hours manually but minutes with AI.

Running “what if” scenarios lets you explore options before committing. What if I put an extra $200 toward my student loans each month? What if I saved the difference from switching to a cheaper phone plan? AI can model these scenarios and show you the long-term impact without you having to build spreadsheets.

Explaining financial concepts in plain language helps you understand options you’re considering. If you’re confused about whether to contribute to a Roth or traditional 401(k), AI can explain the trade-offs in terms specific to your situation and income level. It won’t replace professional advice for complex decisions, but it can help you understand what questions to ask.

How to Prompt AI for Better Financial Help

The quality of AI’s financial guidance depends heavily on how you ask. Vague questions get vague answers. Specific, context-rich prompts get actionable advice.

Be specific about your numbers. Instead of “How can I save more money?”, try “I make $4,200/month after taxes. My rent is $1,100, car payment $350, and I’m spending about $400/month on food. I want to save $5,000 by June. What should I cut or adjust?” The AI can only help with what you tell it.

State your constraints and priorities. If you’re not willing to sell your car or get a roommate, say so upfront. If your priority is paying off debt before saving, make that clear. The more context you provide about what matters to you, the more relevant the suggestions become.

Ask for alternatives, not just one answer. Prompt with “Give me three different approaches to reach this goal” and you’ll get options to compare. One approach might be aggressive, one moderate, one conservative. Having choices helps you find a path that actually fits your life.

Follow up with clarifying questions. If the AI suggests putting $500/month toward savings but you don’t see how, ask “Where would that $500 come from based on my current expenses?” Good AI tools will drill down into specifics when pressed.

Request explanations for recommendations. When AI suggests something, asking “Why this approach instead of alternatives?” helps you understand the reasoning. This also exposes when the AI’s logic might be flawed or based on assumptions that don’t apply to your situation.

The 80% Accuracy Problem

Financial experts describe current AI tools as “about 80% correct, but that 20% could get you in trouble.” This framing helps set realistic expectations. AI is useful for thinking through problems and generating ideas, but you should verify anything that matters before acting on it.

Tax information ages quickly. AI training data has a cutoff date, and tax laws change annually. The AI might tell you about contribution limits, deduction rules, or credit eligibility that was accurate when it learned the information but has since changed. Always verify tax-specific guidance against current IRS resources or a tax professional.

Investment advice should be treated skeptically. AI can explain concepts like compound interest or help you understand different account types. But it shouldn’t be making specific investment recommendations, and if it does, don’t act on them without independent research.

Calculations can contain errors. AI is generally good at math, but it can make mistakes, especially with complex multi-step calculations or when making assumptions you didn’t state. Double-check any numbers that will drive real financial decisions.

Personal situations have nuances AI can’t see. The AI doesn’t know about your company’s upcoming layoffs, your spouse’s health situation, or your emotional relationship with money. It can only work with what you tell it, and there’s always context you haven’t shared.

Sample Prompts to Get Started

Here are effective prompts for common financial goals. Adapt them with your own numbers and circumstances.

For debt payoff planning: “I have the following debts: $8,000 credit card at 22% APR, $15,000 car loan at 6.5%, and $25,000 student loans at 5.5%. I can put $600/month toward debt beyond minimum payments. Should I use the avalanche or snowball method, and how long would each take?”

For emergency fund building: “I currently have $500 saved. My monthly expenses are about $3,200. I want to build a 3-month emergency fund. I can save $300/month right now. What’s my timeline, and what would it look like if I increased to $400/month?”

For retirement planning basics: “I’m 32, earn $65,000/year, and just started contributing to my 401(k). My employer matches 50% up to 6%. Help me understand: should I contribute more than 6%? What’s the difference between traditional and Roth 401(k) at my income level?”

For major purchase savings: “I want to buy a house in 3 years. Homes in my area cost around $350,000. How much should I plan to save for a down payment, closing costs, and moving expenses? Break it down into monthly savings targets.”

For budget creation: “Here’s what I spent last month [paste expenses]. My take-home pay is $4,500. Create a budget that actually works for me that prioritizes paying off my credit card while still letting me have some fun money.”

When to Use AI vs. When to See a Professional

AI tools are best for thinking through decisions, organizing information, and understanding concepts. They’re free, available 24/7, and infinitely patient with follow-up questions. But they have clear limitations.

Use AI for everyday budgeting questions, understanding financial concepts, breaking down goals into steps, comparing basic options, and getting organized before meeting with a professional.

See a human professional for tax preparation and planning, investment portfolio management, estate planning, insurance decisions, complex debt situations, and any decision involving substantial money where mistakes could be costly.

Use both together by preparing with AI first. If you’re planning to see a financial advisor, use AI to clarify your goals, organize your financial information, and develop questions to ask. You’ll get more value from paid professional time when you arrive prepared.

The line isn’t always clear, and your comfort with improving your credit score or managing debt might determine how much AI assistance you need versus professional guidance. Simple situations with straightforward solutions work well with AI alone. Complex situations with significant consequences warrant professional advice.

Summary

AI tools can genuinely help you set and pursue financial goals. They excel at breaking large goals into monthly targets, organizing messy financial data, running what-if scenarios, and explaining concepts in plain language. The key is providing specific information about your situation and asking focused questions that give the AI enough context to help.

Keep the “80% accurate” framing in mind. AI is a brainstorming partner, not an authoritative source. Verify anything tax-related, investment-specific, or based on current regulations before acting. Use AI to prepare for decisions and meetings with professionals, not as a replacement for expert advice when the stakes are high. With appropriate expectations, AI becomes a powerful free tool for taking control of your finances.